The Tree Structure¶

Overview¶

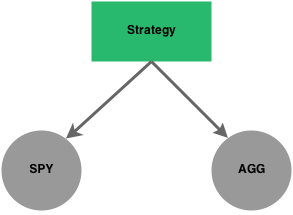

In addition to the concept of Algos and AlgoStacks, a tree structure lies

at the heart of the framework. It allows you to mix and match securities and strategies in order to express

your sophisticated trading ideas. Here is a very simple diagram to help explain this concept:

This diagram represents the strategy we tested in the overview example. A simple strategy

with two children that happen to be securities. However, children nodes don’t have to be

securities. They can also be strategies. This concept is very powerful as it

allows you to combine strategies together and allocate capital dynamically

between different strategies as time progresses using sophisticated allocation

logic. This is similar to what hedge funds do - they have a portfolio of strategies and dynamically allocate capital

according to a set of rules.

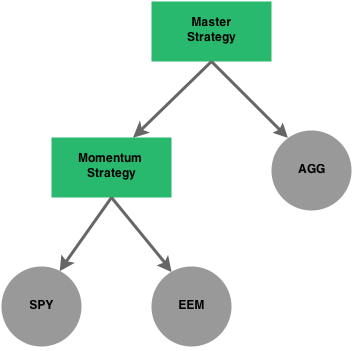

For example, say we didn’t mind having a passive bond allocation (AGG in the above graph), but we wanted to swap out the equity portion (SPY) for something a little more sophisticated. In this case, we will swap out the SPY node for another strategy. This strategy could be a momentum strategy that attempts to pick the best performing ETF every month (to keep it simple, let’s say it picks either the SPY or the EEM based on total return over the past 3 months).

Here is the updated graph:

This approach allows you to build complex systems even though all of the building blocks may be relatively simple. Hopefully you can see how powerful this can be when designing and testing quantitative strategies.

Oh and here’s the code for the second example - not much more complex:

import bt

# create the momentum strategy - we will specify the children (3rd argument)

# to limit the universe the strategy can choose from

mom_s = bt.Strategy('mom_s', [bt.algos.RunMonthly(),

bt.algos.SelectAll(),

bt.algos.SelectMomentum(1),

bt.algos.WeighEqually(),

bt.algos.Rebalance()],

['spy', 'eem'])

# create the parent strategy - this is the top-most node in the tree

# Once again, we are also specifying the children. In this case, one of the

# children is a Security and the other is a Strategy.

parent = bt.Strategy('parent', [bt.algos.RunMonthly(),

bt.algos.SelectAll(),

bt.algos.WeighEqually(),

bt.algos.Rebalance()],

[mom_s, 'agg'])

# create the backtest and run it

t = bt.Backtest(parent, data)

r = bt.run(t)

For even more sophisticated strategies, sub-strategies can be dynamically created by constructing them with the appropriate parent argument. The code below is equivalent to the example above, but knowledge of the sub-strategy is not needed at construction time of the parent:

# create the parent strategy first - this is the top-most node in the tree

# To start, there is only one child, which is a Security

parent = bt.Strategy('parent', [bt.algos.RunMonthly(),

bt.algos.SelectAll(),

bt.algos.WeighEqually(),

bt.algos.Rebalance()],

['agg'])

# Create the momentum strategy dynamically - we will specify the children

# (3rd argument) to limit the universe the strategy can choose from

mom_s = bt.Strategy('mom_s', [bt.algos.RunMonthly(),

bt.algos.SelectAll(),

bt.algos.SelectMomentum(1),

bt.algos.WeighEqually(),

bt.algos.Rebalance()],

['spy', 'eem'], parent = parent)

# create the backtest and run it

t = bt.Backtest(parent, data)

r = bt.run(t)

While this seems like a trivial example, it enables algos to create sub-strategies on-the-fly (based on market conditions/triggers) and register them to the target. Each of these sub-strategies will have its own algos and performance measurement.

Types¶

The base class for nodes in the tree is Node, and these

can be either of type StrategyBase or

SecurityBase.

Each node offers an interface to the current values of many quantities of interest (price, value, weight, etc), which is useful for building Algos. Furthermore, they also offer an interface to the history of these quantities, which is useful for building path-dependent algos as well as for drilling into the strategy behavior after the backtest has run.

For more information, see the APIs for Node,

SecurityBase and StrategyBase.

- There are two main sub-types of

StrategyBase: FixedIncomeStrategy: Notional weighted strategy based onAlgos.

- There are also two main sub-types of

SecurityBase: Security: Standard security. If used within aFixedIncomeStrategy, its notional weight is equal to market value. i.e. common stock.CouponPayingSecurity: A security that pays regular or irregular cashflows, and can have (asymmetric) holding costs. i.e. a corporate bond with funding and repo costs, or an unfunded swap.

When using FixedIncomeStrategy,

there are additional security types that are helpful due to the different

treatment of their notional weight in the portfolio. These have no effect in a standard

Strategy.

FixedIncomeSecurity: ASecurityfor which position (rather than market value) will be used as the notional weight, i.e. a zero-coupon bond.

HedgeSecurity: ASecurityfor which the notional weight is zero, i.e. an ETF hedge in a bond strategy.

CouponPayingHedgeSecurity: ACouponPayingSecurityfor which the notional weight is zero, i.e. a rates swap hedge in a CDS strategy.

As in the examples, a list of strings can be passed to the strategy constructors,

which will be automatically converted to instances of Security

when needed. For more fine-grained control over which security types are used

(or over other arguments like the `multiplier`), explicitly construct the

security nodes yourself before passing them to the strategy.