Examples¶

Here are a few examples to give you a better idea of what bt is all about.

SMA Strategy¶

Let’s start off with a Simple Moving Average (SMA) strategy. We will start with a simple version of the strategy, namely:

Select the securities that are currently above their 50 day moving average

Weigh each selected security equally

Rebalance the portfolio to reflect the target weights

This should be pretty simple to build. The only thing missing above is the calculation of the simple moving average. When should this take place?

Given the flexibility of bt, there is no strict rule. The average calculation could be performed in an Algo, but that would be pretty inefficient. A better way would be to calculate the moving average at the beginning - before starting the backtest. After all, all the data is known in advance.

Now that we know what we have to do, let’s get started. First we will download some data and calculate the simple moving average.

import bt

%matplotlib inline

# download data

data = bt.get('aapl,msft,c,gs,ge', start='2010-01-01')

# calculate moving average DataFrame using pandas' rolling_mean

import pandas as pd

# a rolling mean is a moving average, right?

sma = data.rolling(50).mean()

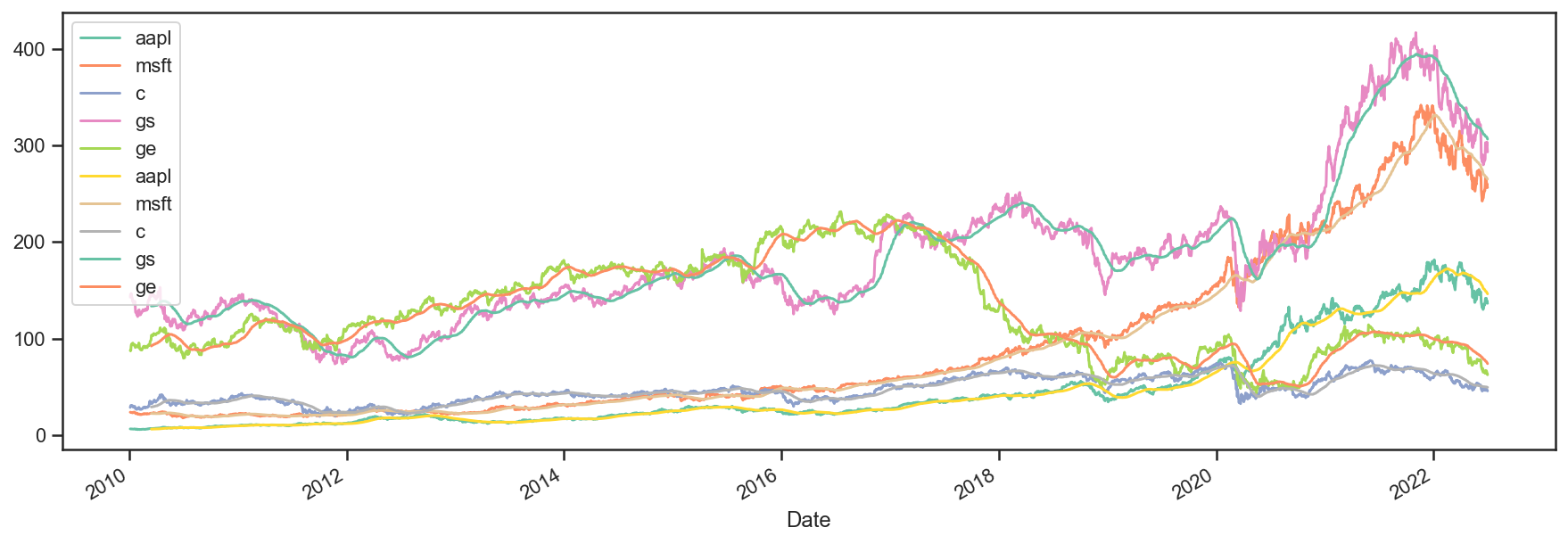

It’s always a good idea to plot your data to make sure it looks ok. So let’s see how the data + sma plot looks like.

# let's see what the data looks like - this is by no means a pretty chart, but it does the job

plot = bt.merge(data, sma).plot(figsize=(15, 5))

Looks legit.

Now that we have our data, we will need to create our security selection logic. Let’s create a basic Algo that will select the securities that are above their moving average.

Before we do that, let’s think about how we will code it. We could pass the SMA data and then extract the row (from the sma DataFrame) on the current date, compare the values to the current prices, and then keep a list of those securities where the price is above the SMA. This is the most straightforward approach. However, this is not very re-usable because the logic within the Algo will be quite specific to the task at hand and if we wish to change the logic, we will have to write a new algo.

For example, what if we wanted to select securities that were below their sma? Or what if we only wanted securities that were 5% above their sma?

What we could do instead is pre-calculate the selection logic DataFrame (a fast, vectorized operation) and write a generic Algo that takes in this boolean DataFrame and returns the securities where the value is True on a given date. This will be must faster and much more reusable. Let’s see how the implementation looks like.

class SelectWhere(bt.Algo):

"""

Selects securities based on an indicator DataFrame.

Selects securities where the value is True on the current date (target.now).

Args:

* signal (DataFrame): DataFrame containing the signal (boolean DataFrame)

Sets:

* selected

"""

def __init__(self, signal):

self.signal = signal

def __call__(self, target):

# get signal on target.now

if target.now in self.signal.index:

sig = self.signal.loc[target.now]

# get indices where true as list

selected = list(sig.index[sig])

# save in temp - this will be used by the weighing algo

target.temp['selected'] = selected

# return True because we want to keep on moving down the stack

return True

So there we have it. Our selection Algo.

Note

By the way, this Algo already exists - I just wanted to show you how you would code it from scratch.

Here is the code.

All we have to do now is pass in a signal matrix. In our case, it’s quite easy:

signal = data > sma

Simple, concise and more importantly, fast! Let’s move on and test the strategy.

# first we create the Strategy

s = bt.Strategy('above50sma', [SelectWhere(data > sma),

bt.algos.WeighEqually(),

bt.algos.Rebalance()])

# now we create the Backtest

t = bt.Backtest(s, data)

# and let's run it!

res = bt.run(t)

So just to recap, we created the strategy, created the backtest by joining Strategy+Data, and ran the backtest. Let’s see the results.

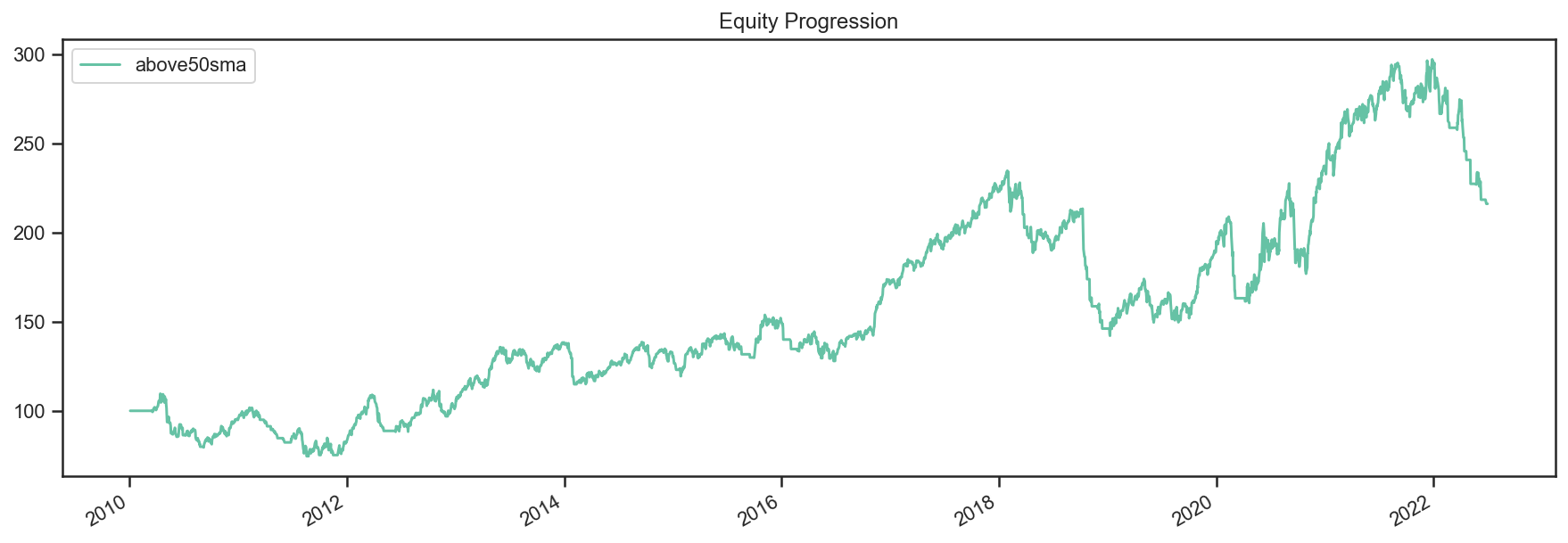

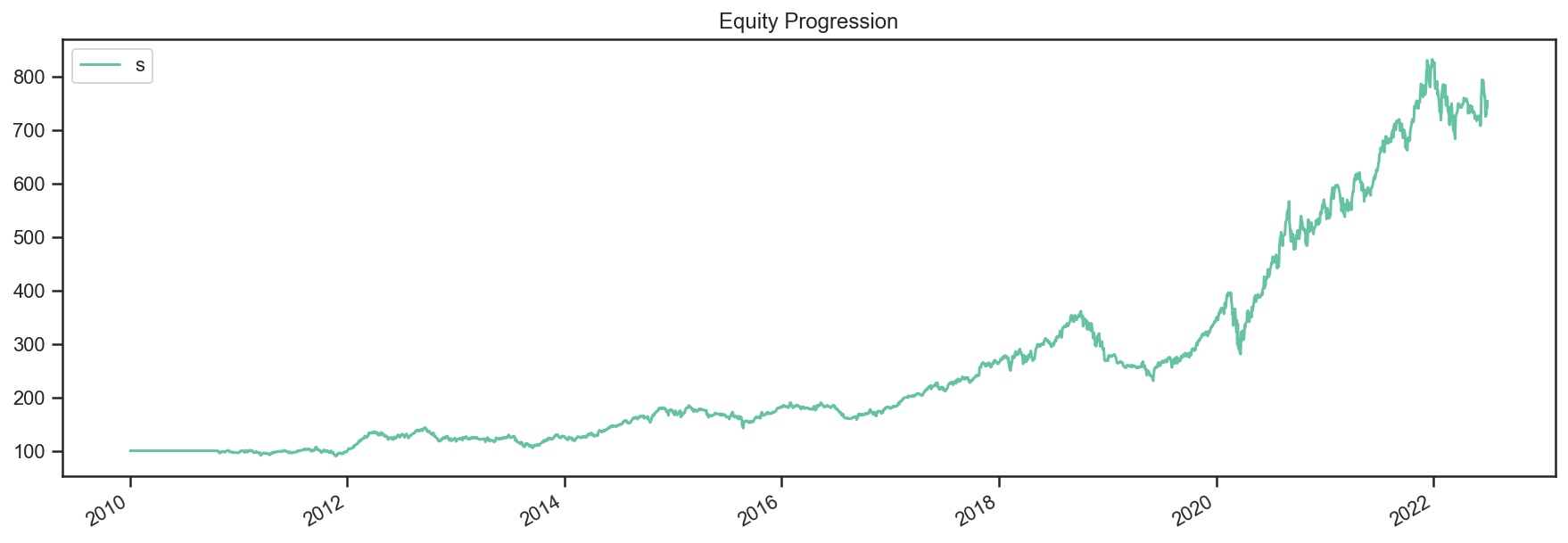

# what does the equity curve look like?

res.plot();

# and some performance stats

res.display()

Stat above50sma

------------------- ------------

Start 2010-01-03

End 2022-07-01

Risk-free rate 0.00%

Total Return 116.08%

Daily Sharpe 0.42

Daily Sortino 0.63

CAGR 6.36%

Max Drawdown -39.43%

Calmar Ratio 0.16

MTD 0.00%

3m -19.50%

6m -26.03%

YTD -26.03%

1Y -22.10%

3Y (ann.) 10.34%

5Y (ann.) 1.89%

10Y (ann.) 8.70%

Since Incep. (ann.) 6.36%

Daily Sharpe 0.42

Daily Sortino 0.63

Daily Mean (ann.) 8.07%

Daily Vol (ann.) 19.45%

Daily Skew -0.65

Daily Kurt 4.74

Best Day 5.78%

Worst Day -8.26%

Monthly Sharpe 0.39

Monthly Sortino 0.65

Monthly Mean (ann.) 8.59%

Monthly Vol (ann.) 21.86%

Monthly Skew -0.37

Monthly Kurt 0.73

Best Month 21.65%

Worst Month -17.26%

Yearly Sharpe 0.41

Yearly Sortino 0.83

Yearly Mean 9.78%

Yearly Vol 23.65%

Yearly Skew -0.88

Yearly Kurt -0.67

Best Year 34.85%

Worst Year -34.38%

Avg. Drawdown -3.56%

Avg. Drawdown Days 47.27

Avg. Up Month 4.76%

Avg. Down Month -5.35%

Win Year % 66.67%

Win 12m % 67.14%

Nothing stellar but at least you learnt something along the way (I hope).

Oh, and one more thing. If you were to write your own “library” of backtests, you might want to write yourself a helper function that would allow you to test different parameters and securities. That function might look something like this:

def above_sma(tickers, sma_per=50, start='2010-01-01', name='above_sma'):

"""

Long securities that are above their n period

Simple Moving Averages with equal weights.

"""

# download data

data = bt.get(tickers, start=start)

# calc sma

sma = data.rolling(sma_per).mean()

# create strategy

s = bt.Strategy(name, [SelectWhere(data > sma),

bt.algos.WeighEqually(),

bt.algos.Rebalance()])

# now we create the backtest

return bt.Backtest(s, data)

This function allows us to easily generate backtests. We could easily compare a few different SMA periods. Also, let’s see if we can beat a long-only allocation to the SPY.

# simple backtest to test long-only allocation

def long_only_ew(tickers, start='2010-01-01', name='long_only_ew'):

s = bt.Strategy(name, [bt.algos.RunOnce(),

bt.algos.SelectAll(),

bt.algos.WeighEqually(),

bt.algos.Rebalance()])

data = bt.get(tickers, start=start)

return bt.Backtest(s, data)

# create the backtests

tickers = 'aapl,msft,c,gs,ge'

sma10 = above_sma(tickers, sma_per=10, name='sma10')

sma20 = above_sma(tickers, sma_per=20, name='sma20')

sma40 = above_sma(tickers, sma_per=40, name='sma40')

benchmark = long_only_ew('spy', name='spy')

# run all the backtests!

res2 = bt.run(sma10, sma20, sma40, benchmark)

res2.plot(freq='m');

res2.display()

Stat sma10 sma20 sma40 spy

------------------- ---------- ---------- ---------- ----------

Start 2010-01-03 2010-01-03 2010-01-03 2010-01-03

End 2022-07-01 2022-07-01 2022-07-01 2022-07-01

Risk-free rate 0.00% 0.00% 0.00% 0.00%

Total Return 284.16% 229.80% 145.62% 321.22%

Daily Sharpe 0.63 0.58 0.47 0.75

Daily Sortino 0.99 0.91 0.73 1.15

CAGR 11.38% 10.03% 7.46% 12.20%

Max Drawdown -31.77% -40.72% -34.93% -33.72%

Calmar Ratio 0.36 0.25 0.21 0.36

MTD -0.76% 0.00% 0.00% -0.37%

3m -10.58% -22.25% -18.82% -16.66%

6m -10.71% -32.14% -30.31% -20.28%

YTD -10.71% -32.14% -30.31% -20.28%

1Y -13.63% -24.65% -27.20% -11.44%

3Y (ann.) 28.10% 14.77% 3.73% 10.10%

5Y (ann.) 15.80% 8.37% 1.96% 11.11%

10Y (ann.) 13.76% 10.96% 9.67% 12.78%

Since Incep. (ann.) 11.38% 10.03% 7.46% 12.20%

Daily Sharpe 0.63 0.58 0.47 0.75

Daily Sortino 0.99 0.91 0.73 1.15

Daily Mean (ann.) 12.88% 11.52% 9.01% 13.03%

Daily Vol (ann.) 20.48% 19.79% 18.97% 17.34%

Daily Skew -0.11 -0.29 -0.45 -0.59

Daily Kurt 6.61 6.23 4.32 11.75

Best Day 10.47% 10.47% 6.20% 9.06%

Worst Day -8.26% -8.26% -8.26% -10.94%

Monthly Sharpe 0.65 0.54 0.43 0.92

Monthly Sortino 1.18 1.02 0.75 1.62

Monthly Mean (ann.) 13.56% 11.95% 9.71% 13.00%

Monthly Vol (ann.) 20.96% 21.94% 22.42% 14.20%

Monthly Skew -0.02 0.22 -0.10 -0.40

Monthly Kurt 1.01 1.11 0.67 0.89

Best Month 22.75% 24.73% 21.97% 12.70%

Worst Month -16.94% -14.34% -15.86% -12.49%

Yearly Sharpe 0.54 0.43 0.40 0.80

Yearly Sortino 2.01 1.03 0.77 2.15

Yearly Mean 13.38% 13.94% 9.76% 12.67%

Yearly Vol 24.64% 32.80% 24.22% 15.79%

Yearly Skew 0.41 -0.15 -0.87 -0.68

Yearly Kurt -0.43 -0.96 -0.59 0.12

Best Year 62.47% 66.99% 39.35% 32.31%

Worst Year -18.59% -37.01% -32.06% -20.28%

Avg. Drawdown -3.95% -3.49% -3.68% -1.69%

Avg. Drawdown Days 40.43 35.12 48.79 15.92

Avg. Up Month 4.68% 5.00% 4.69% 3.20%

Avg. Down Month -5.00% -4.85% -5.70% -3.56%

Win Year % 58.33% 66.67% 75.00% 83.33%

Win 12m % 68.57% 66.43% 69.29% 91.43%

And there you have it. Beating the market ain’t that easy!

SMA Crossover Strategy¶

Let’s build on the last section to test a moving average crossover strategy. The easiest way to achieve this is to build an Algo similar to SelectWhere, but for the purpose of setting target weights. Let’s call this algo WeighTarget. This algo will take a DataFrame of target weights that we will pre-calculate.

Basically, when the 50 day moving average will be above the 200-day moving average, we will be long (+1 target weight). Conversely, when the 50 is below the 200, we will be short (-1 target weight).

Here’s the WeighTarget implementation (this Algo also already exists in the algos module):

class WeighTarget(bt.Algo):

"""

Sets target weights based on a target weight DataFrame.

Args:

* target_weights (DataFrame): DataFrame containing the target weights

Sets:

* weights

"""

def __init__(self, target_weights):

self.tw = target_weights

def __call__(self, target):

# get target weights on date target.now

if target.now in self.tw.index:

w = self.tw.loc[target.now]

# save in temp - this will be used by the weighing algo

# also dropping any na's just in case they pop up

target.temp['weights'] = w.dropna()

# return True because we want to keep on moving down the stack

return True

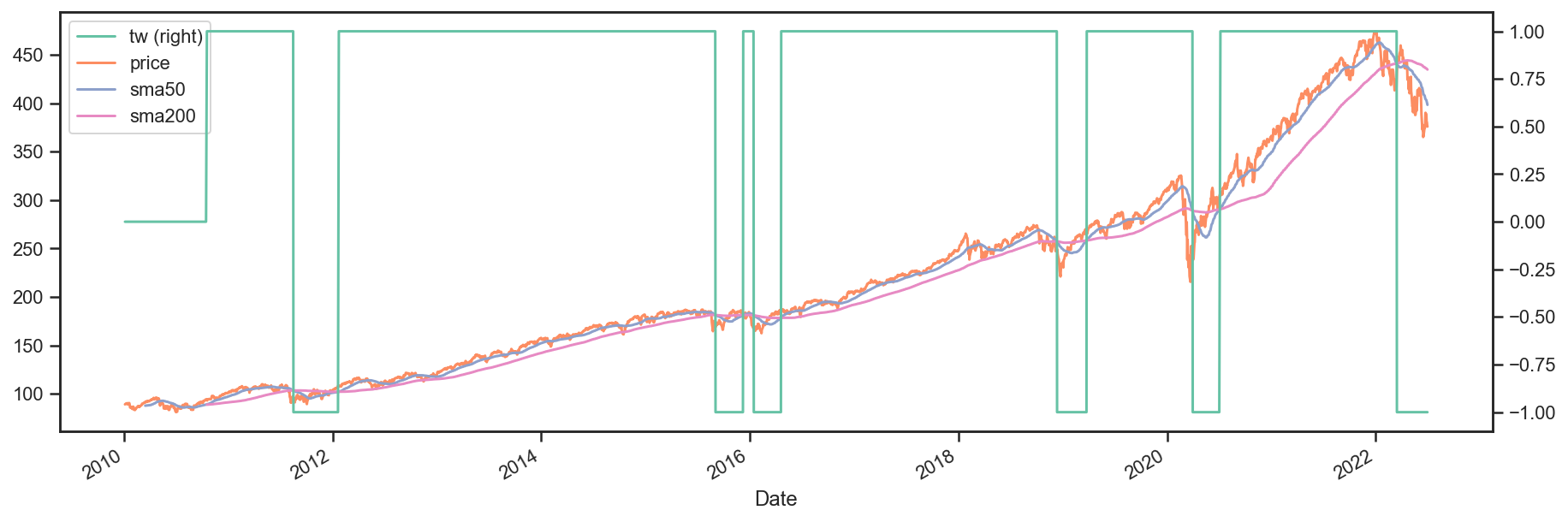

So let’s start with a simple 50-200 day sma crossover for a single security.

## download some data & calc SMAs

data = bt.get('spy', start='2010-01-01')

sma50 = data.rolling(50).mean()

sma200 = data.rolling(200).mean()

## now we need to calculate our target weight DataFrame

# first we will copy the sma200 DataFrame since our weights will have the same strucutre

tw = sma200.copy()

# set appropriate target weights

tw[sma50 > sma200] = 1.0

tw[sma50 <= sma200] = -1.0

# here we will set the weight to 0 - this is because the sma200 needs 200 data points before

# calculating its first point. Therefore, it will start with a bunch of nulls (NaNs).

tw[sma200.isnull()] = 0.0

Ok so we downloaded our data, calculated the simple moving averages, and then we setup our target weight (tw) DataFrame. Let’s take a look at our target weights to see if they make any sense.

# plot the target weights + chart of price & SMAs

tmp = bt.merge(tw, data, sma50, sma200)

tmp.columns = ['tw', 'price', 'sma50', 'sma200']

ax = tmp.plot(figsize=(15,5), secondary_y=['tw'])

As mentioned earlier, it’s always a good idea to plot your strategy data. It is usually easier to spot logic/programming errors this way, especially when dealing with lots of data.

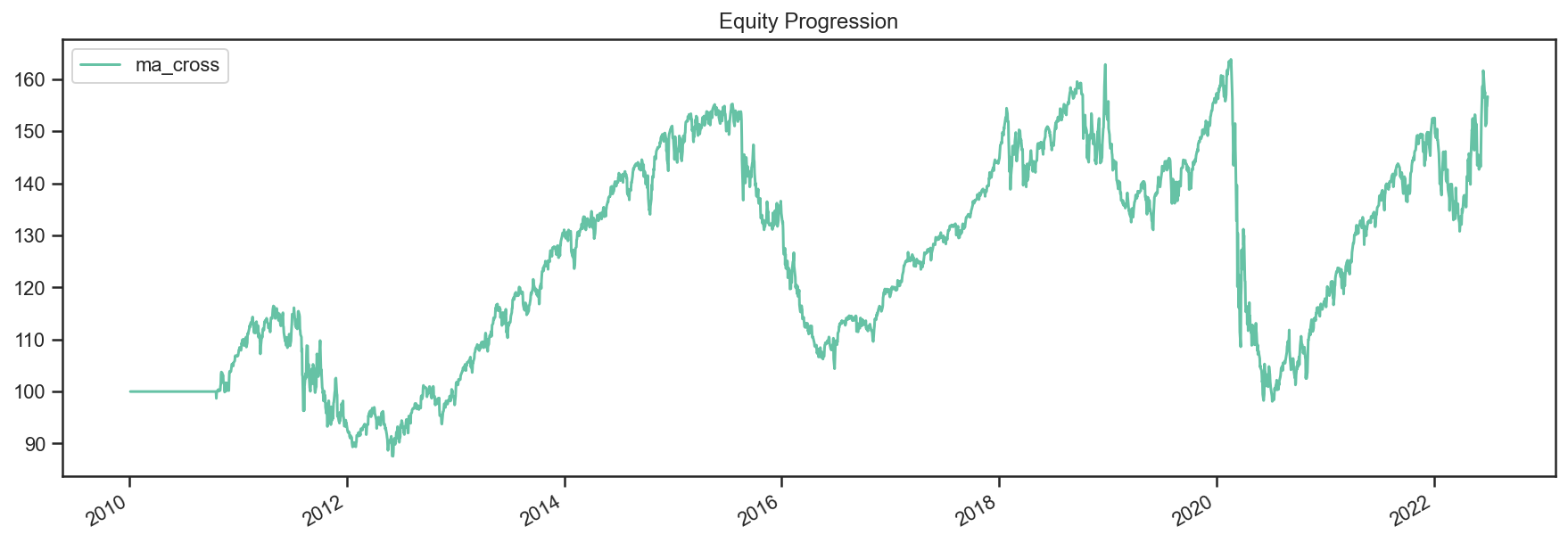

Now let’s move on with the Strategy & Backtest.

ma_cross = bt.Strategy('ma_cross', [WeighTarget(tw),

bt.algos.Rebalance()])

t = bt.Backtest(ma_cross, data)

res = bt.run(t)

res.plot();

Ok great so there we have our basic moving average crossover strategy.

Exploring the Tree Structure¶

So far, we have explored strategies that allocate capital to securities. But what if we wanted to test a strategy that allocated capital to sub-strategies?

The most straightforward way would be to test the different sub-strategies, extract their equity curves and create “synthetic securities” that would basically just represent the returns achieved from allocating capital to the different sub-strategies.

Let’s see how this looks:

# first let's create a helper function to create a ma cross backtest

def ma_cross(ticker, start='2010-01-01',

short_ma=50, long_ma=200, name='ma_cross'):

# these are all the same steps as above

data = bt.get(ticker, start=start)

short_sma = data.rolling(short_ma).mean()

long_sma = data.rolling(long_ma).mean()

# target weights

tw = long_sma.copy()

tw[short_sma > long_sma] = 1.0

tw[short_sma <= long_sma] = -1.0

tw[long_sma.isnull()] = 0.0

# here we specify the children (3rd) arguemnt to make sure the strategy

# has the proper universe. This is necessary in strategies of strategies

s = bt.Strategy(name, [WeighTarget(tw), bt.algos.Rebalance()], [ticker])

return bt.Backtest(s, data)

# ok now let's create a few backtests and gather the results.

# these will later become our "synthetic securities"

t1 = ma_cross('aapl', name='aapl_ma_cross')

t2 = ma_cross('msft', name='msft_ma_cross')

# let's run these strategies now

res = bt.run(t1, t2)

# now that we have run the strategies, let's extract

# the data to create "synthetic securities"

data = bt.merge(res['aapl_ma_cross'].prices, res['msft_ma_cross'].prices)

# now we have our new data. This data is basically the equity

# curves of both backtested strategies. Now we can just use this

# to test any old strategy, just like before.

s = bt.Strategy('s', [bt.algos.SelectAll(),

bt.algos.WeighInvVol(),

bt.algos.Rebalance()])

# create and run

t = bt.Backtest(s, data)

res = bt.run(t)

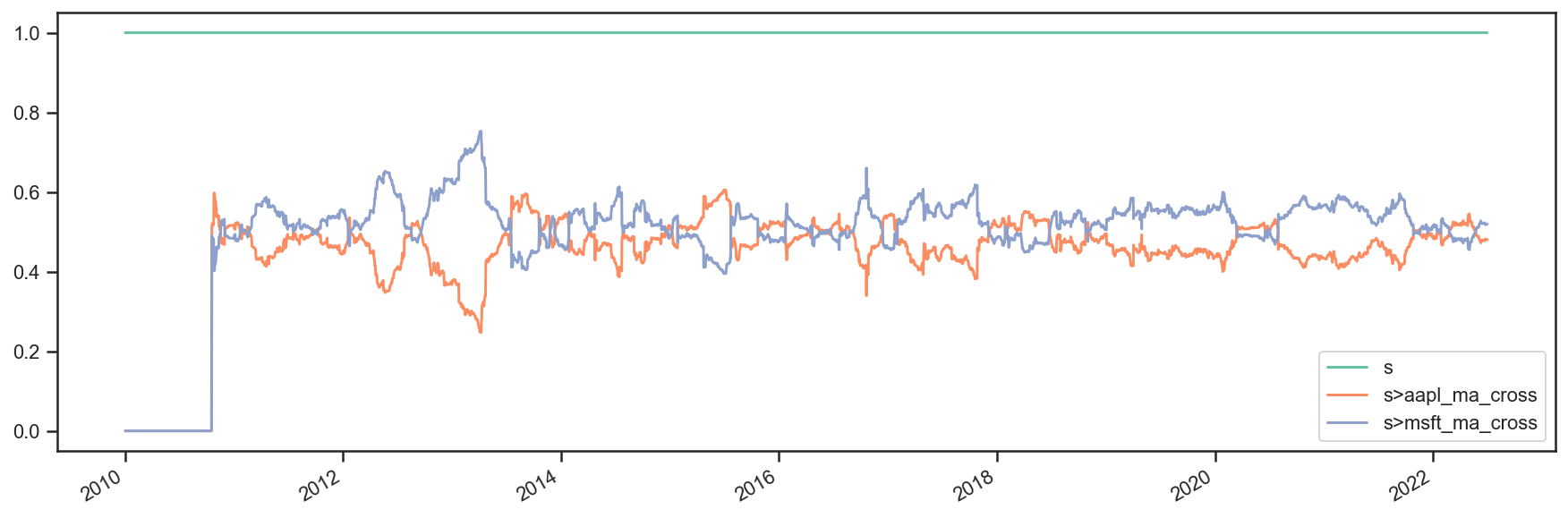

res.plot();

res.plot_weights();

As we can see above, the process is a bit more involved, but it works. It is not very elegant though, and obtaining security-level allocation information is problematic.

Luckily, bt has built-in functionality for dealing with strategies of strategies. It uses the same general principal as demonstrated above but does it seamlessly. Basically, when a strategy is a child of another strategy, it will create a “paper trade” version of itself internally. As we run our strategy, it will run its internal “paper version” and use the returns from that strategy to populate the price property.

This means that the parent strategy can use the price information (which reflects the returns of the strategy had it been employed) to determine the appropriate allocation. Again, this is basically the same process as above, just packed into 1 step.

Perhaps some code will help:

# once again, we will create a few backtests

# these will be the child strategies

t1 = ma_cross('aapl', name='aapl_ma_cross')

t2 = ma_cross('msft', name='msft_ma_cross')

# let's extract the data object

data = bt.merge(t1.data, t2.data)

# now we create the parent strategy

# we specify the children to be the two

# strategies created above

s = bt.Strategy('s', [bt.algos.SelectAll(),

bt.algos.WeighInvVol(),

bt.algos.Rebalance()],

[t1.strategy, t2.strategy])

# create and run

t = bt.Backtest(s, data)

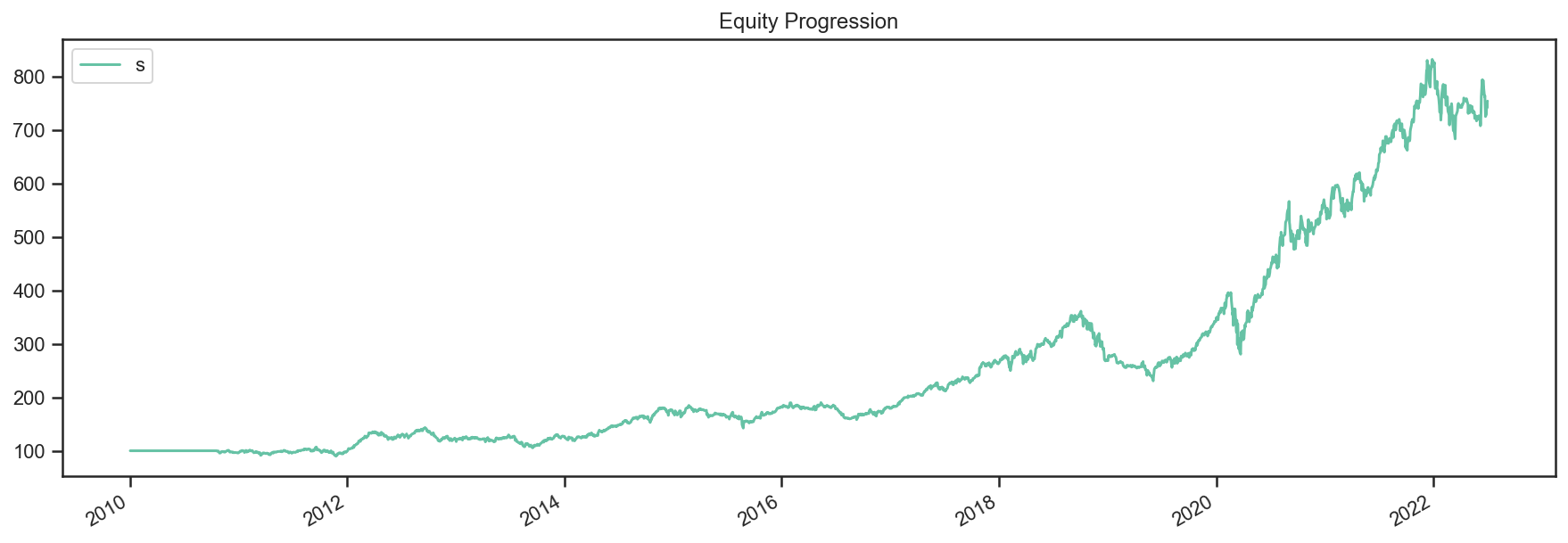

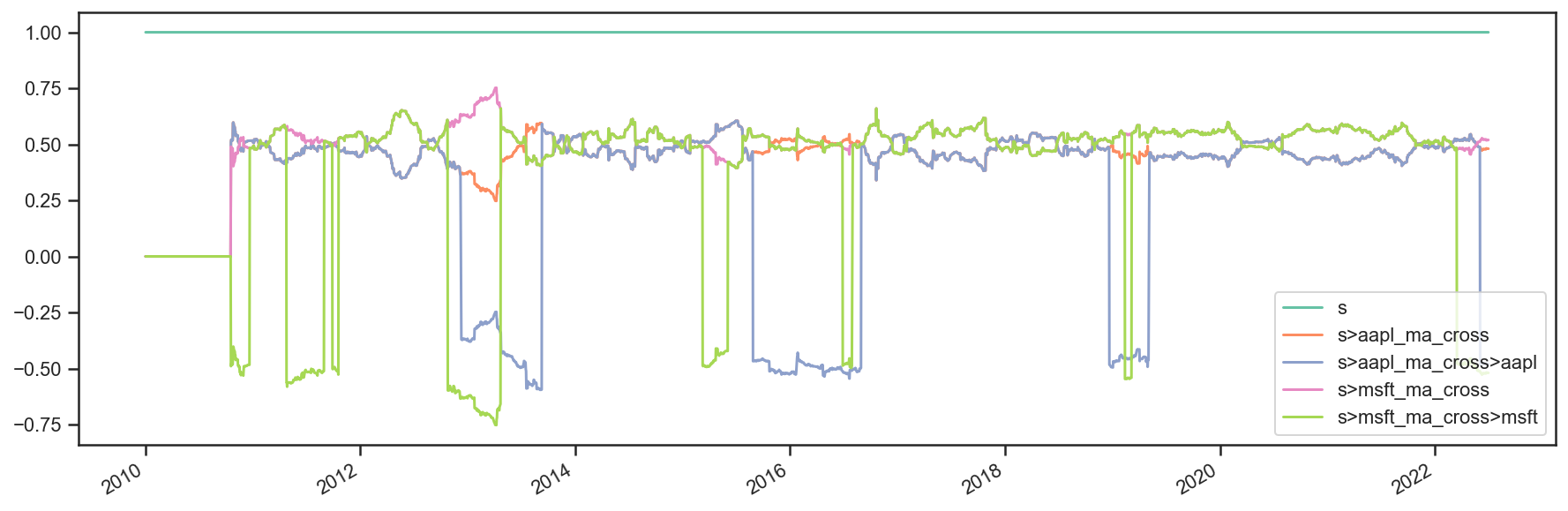

res = bt.run(t)

res.plot();

res.plot_weights();

So there you have it. Simpler, and more complete.

Buy and Hold Strategy¶

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import ffn

import bt

%matplotlib inline

Create Fake Index Data¶

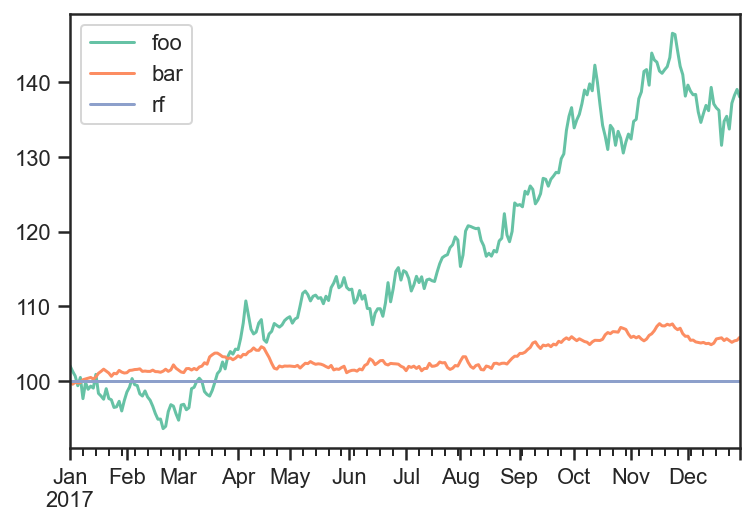

names = ['foo','bar','rf']

dates = pd.date_range(start='2017-01-01',end='2017-12-31', freq=pd.tseries.offsets.BDay())

n = len(dates)

rdf = pd.DataFrame(

np.zeros((n, len(names))),

index = dates,

columns = names

)

np.random.seed(1)

rdf['foo'] = np.random.normal(loc = 0.1/n,scale=0.2/np.sqrt(n),size=n)

rdf['bar'] = np.random.normal(loc = 0.04/n,scale=0.05/np.sqrt(n),size=n)

rdf['rf'] = 0.

pdf = 100*np.cumprod(1+rdf)

pdf.plot();

Build Strategy¶

# algo to fire on the beginning of every month and to run on the first date

runMonthlyAlgo = bt.algos.RunMonthly(

run_on_first_date=True

)

# algo to set the weights

# it will only run when runMonthlyAlgo returns true

# which only happens on the first of every month

weights = pd.Series([0.6,0.4,0.],index = rdf.columns)

weighSpecifiedAlgo = bt.algos.WeighSpecified(**weights)

# algo to rebalance the current weights to weights set by weighSpecified

# will only run when weighSpecifiedAlgo returns true

# which happens every time it runs

rebalAlgo = bt.algos.Rebalance()

# a strategy that rebalances monthly to specified weights

strat = bt.Strategy('static',

[

runMonthlyAlgo,

weighSpecifiedAlgo,

rebalAlgo

]

)

Run Backtest¶

Note: The logic of the strategy is seperate from the data used in the backtest.

# set integer_positions=False when positions are not required to be integers(round numbers)

backtest = bt.Backtest(

strat,

pdf,

integer_positions=False

)

res = bt.run(backtest)

res.stats

| static | |

|---|---|

| start | 2017-01-01 00:00:00 |

| end | 2017-12-29 00:00:00 |

| rf | 0.0 |

| total_return | 0.229372 |

| cagr | 0.231653 |

| max_drawdown | -0.069257 |

| calmar | 3.344851 |

| mtd | -0.000906 |

| three_month | 0.005975 |

| six_month | 0.142562 |

| ytd | 0.229372 |

| one_year | NaN |

| three_year | NaN |

| five_year | NaN |

| ten_year | NaN |

| incep | 0.231653 |

| daily_sharpe | 1.804549 |

| daily_sortino | 3.306154 |

| daily_mean | 0.206762 |

| daily_vol | 0.114578 |

| daily_skew | 0.012208 |

| daily_kurt | -0.04456 |

| best_day | 0.020402 |

| worst_day | -0.0201 |

| monthly_sharpe | 2.806444 |

| monthly_sortino | 15.352486 |

| monthly_mean | 0.257101 |

| monthly_vol | 0.091611 |

| monthly_skew | 0.753881 |

| monthly_kurt | 0.456278 |

| best_month | 0.073657 |

| worst_month | -0.014592 |

| yearly_sharpe | NaN |

| yearly_sortino | NaN |

| yearly_mean | NaN |

| yearly_vol | NaN |

| yearly_skew | NaN |

| yearly_kurt | NaN |

| best_year | NaN |

| worst_year | NaN |

| avg_drawdown | -0.016052 |

| avg_drawdown_days | 12.695652 |

| avg_up_month | 0.03246 |

| avg_down_month | -0.008001 |

| win_year_perc | NaN |

| twelve_month_win_perc | NaN |

res.prices.head()

| static | |

|---|---|

| 2017-01-01 | 100.000000 |

| 2017-01-02 | 100.000000 |

| 2017-01-03 | 99.384719 |

| 2017-01-04 | 99.121677 |

| 2017-01-05 | 98.316364 |

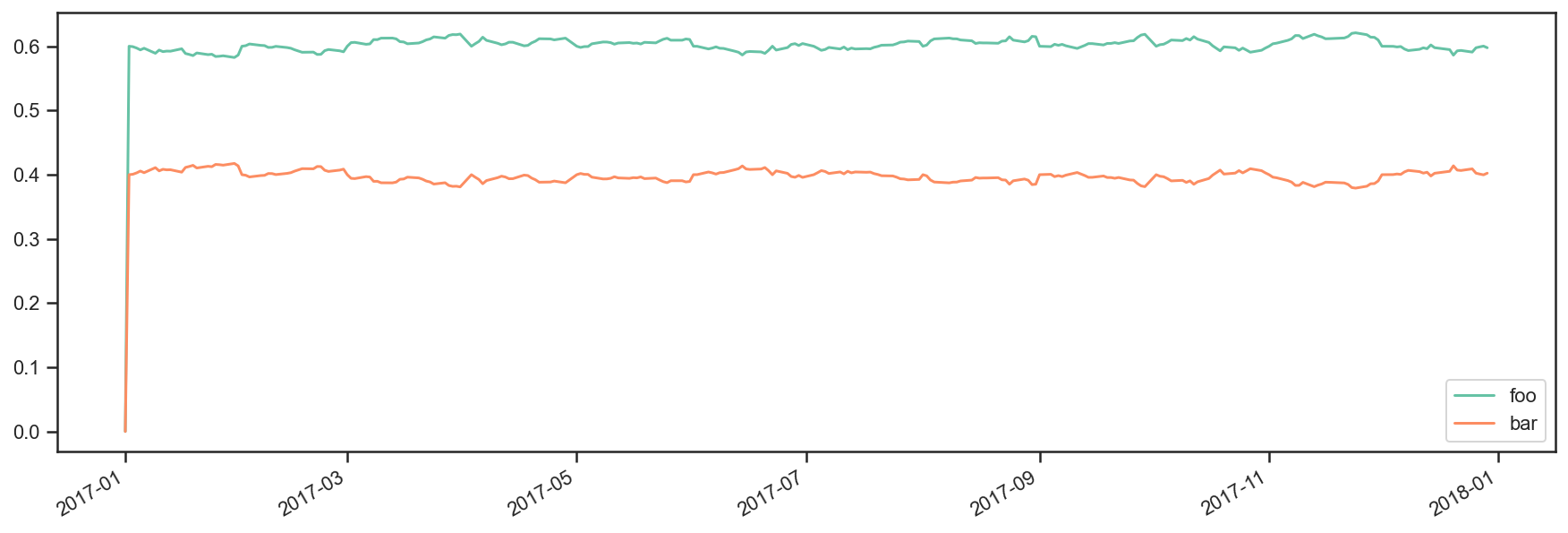

res.plot_security_weights()

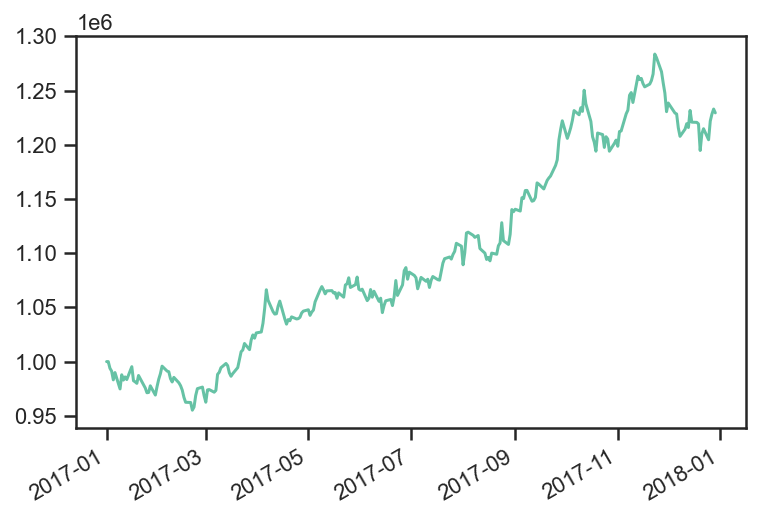

Strategy value over time

performanceStats = res['static']

#performance stats is an ffn object

res.backtest_list[0].strategy.values.plot();

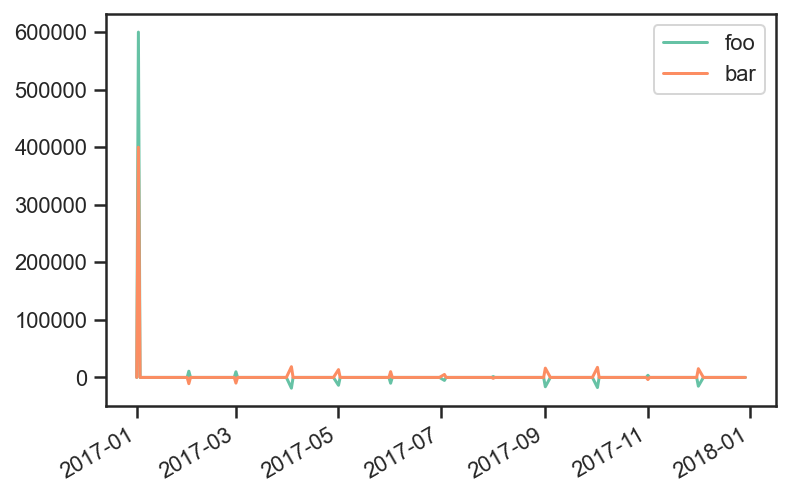

Strategy Outlays

Outlays are the total dollar amount spent(gained) by a purchase(sale) of securities.

res.backtest_list[0].strategy.outlays.plot();

You can get the change in number of shares purchased a

security_names = res.backtest_list[0].strategy.outlays.columns

res.backtest_list[0].strategy.outlays/pdf.loc[:,security_names]

res.backtest_list[0].positions.diff(1)

res.backtest_list[0].positions

| foo | bar | |

|---|---|---|

| 2017-01-01 | 0.000000 | 0.000000 |

| 2017-01-02 | 5879.285683 | 3998.068018 |

| 2017-01-03 | 5879.285683 | 3998.068018 |

| 2017-01-04 | 5879.285683 | 3998.068018 |

| 2017-01-05 | 5879.285683 | 3998.068018 |

| ... | ... | ... |

| 2017-12-25 | 5324.589093 | 4673.239436 |

| 2017-12-26 | 5324.589093 | 4673.239436 |

| 2017-12-27 | 5324.589093 | 4673.239436 |

| 2017-12-28 | 5324.589093 | 4673.239436 |

| 2017-12-29 | 5324.589093 | 4673.239436 |

261 rows × 2 columns

Trend Example 1¶

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import ffn

import bt

%matplotlib inline

Create fake data¶

rf = 0.04

np.random.seed(1)

mus = np.random.normal(loc=0.05,scale=0.02,size=5) + rf

sigmas = (mus - rf)/0.3 + np.random.normal(loc=0.,scale=0.01,size=5)

num_years = 10

num_months_per_year = 12

num_days_per_month = 21

num_days_per_year = num_months_per_year*num_days_per_month

rdf = pd.DataFrame(

index = pd.date_range(

start="2008-01-02",

periods=num_years*num_months_per_year*num_days_per_month,

freq="B"

),

columns=['foo','bar','baz','fake1','fake2']

)

for i,mu in enumerate(mus):

sigma = sigmas[i]

rdf.iloc[:,i] = np.random.normal(

loc=mu/num_days_per_year,

scale=sigma/np.sqrt(num_days_per_year),

size=rdf.shape[0]

)

pdf = np.cumprod(1+rdf)*100

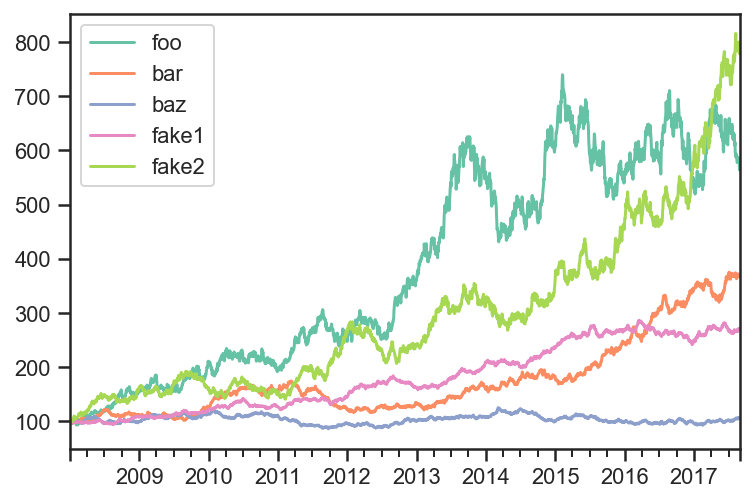

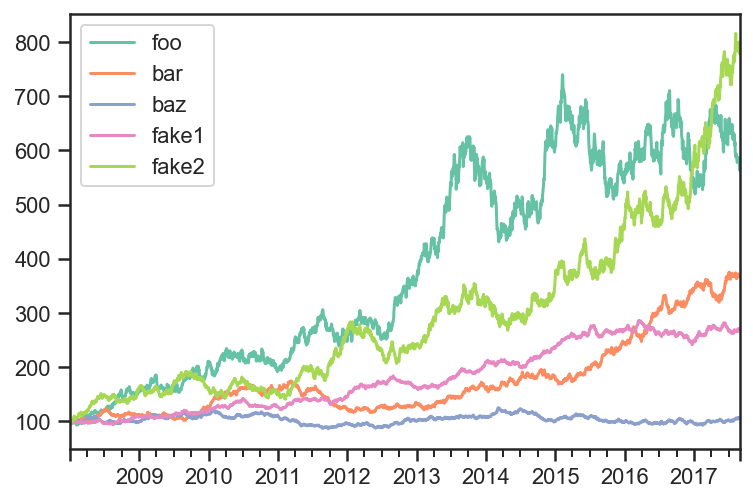

pdf.plot();

Create Trend signal over the last 12 months¶

sma = pdf.rolling(window=num_days_per_month*12,center=False).median().shift(1)

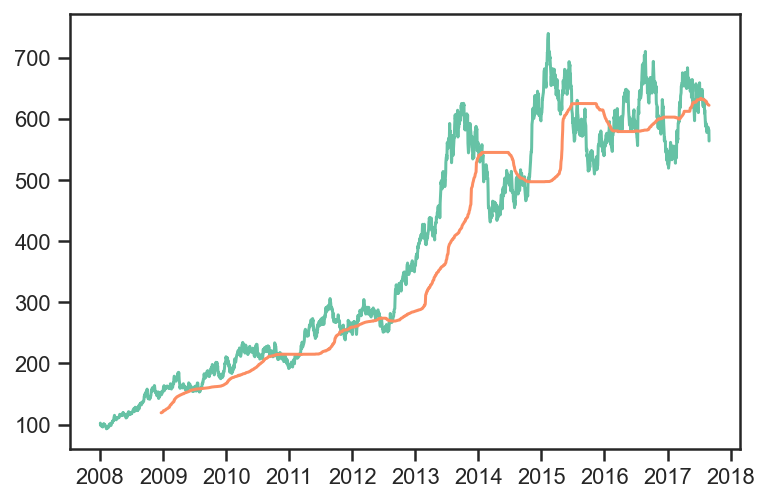

plt.plot(pdf.index,pdf['foo'])

plt.plot(sma.index,sma['foo'])

plt.show()

#sma with 1 day lag

sma.tail()

| foo | bar | baz | fake1 | fake2 | |

|---|---|---|---|---|---|

| 2017-08-23 | 623.241267 | 340.774506 | 99.764885 | 263.491447 | 619.963986 |

| 2017-08-24 | 623.167989 | 341.096742 | 99.764885 | 263.502145 | 620.979948 |

| 2017-08-25 | 622.749149 | 341.316672 | 99.764885 | 263.502145 | 622.421401 |

| 2017-08-28 | 622.353039 | 341.494307 | 99.807732 | 263.517071 | 622.962579 |

| 2017-08-29 | 622.153294 | 341.662442 | 99.807732 | 263.517071 | 622.992416 |

#sma with 0 day lag

pdf.rolling(window=num_days_per_month*12,center=False).median().tail()

| foo | bar | baz | fake1 | fake2 | |

|---|---|---|---|---|---|

| 2017-08-23 | 623.167989 | 341.096742 | 99.764885 | 263.502145 | 620.979948 |

| 2017-08-24 | 622.749149 | 341.316672 | 99.764885 | 263.502145 | 622.421401 |

| 2017-08-25 | 622.353039 | 341.494307 | 99.807732 | 263.517071 | 622.962579 |

| 2017-08-28 | 622.153294 | 341.662442 | 99.807732 | 263.517071 | 622.992416 |

| 2017-08-29 | 621.907867 | 341.948212 | 99.807732 | 263.634283 | 624.310473 |

# target weights

trend = sma.copy()

trend[pdf > sma] = True

trend[pdf <= sma] = False

trend[sma.isnull()] = False

trend.tail()

| foo | bar | baz | fake1 | fake2 | |

|---|---|---|---|---|---|

| 2017-08-23 | False | True | True | True | True |

| 2017-08-24 | False | True | True | True | True |

| 2017-08-25 | False | True | True | True | True |

| 2017-08-28 | False | True | True | True | True |

| 2017-08-29 | False | True | True | True | True |

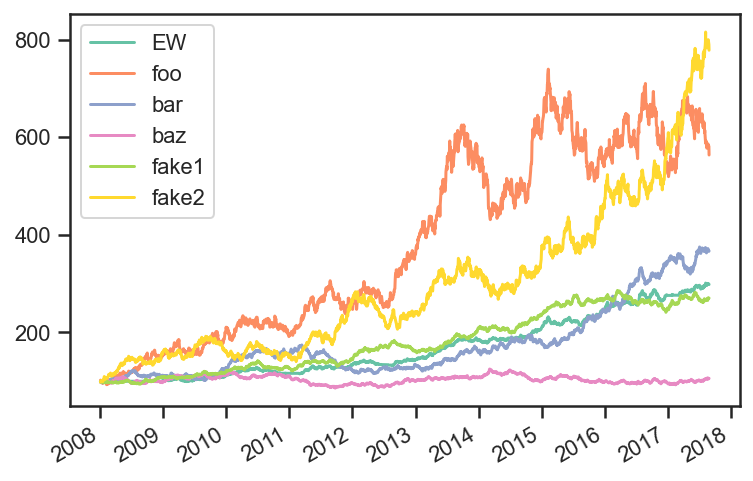

Compare EW and 1/vol

Both strategies rebalance daily using trend with 1 day lag and weights limited to 40%.

tsmom_invvol_strat = bt.Strategy(

'tsmom_invvol',

[

bt.algos.RunDaily(),

bt.algos.SelectWhere(trend),

bt.algos.WeighInvVol(),

bt.algos.LimitWeights(limit=0.4),

bt.algos.Rebalance()

]

)

tsmom_ew_strat = bt.Strategy(

'tsmom_ew',

[

bt.algos.RunDaily(),

bt.algos.SelectWhere(trend),

bt.algos.WeighEqually(),

bt.algos.LimitWeights(limit=0.4),

bt.algos.Rebalance()

]

)

# create and run

tsmom_invvol_bt = bt.Backtest(

tsmom_invvol_strat,

pdf,

initial_capital=50000000.0,

commissions=lambda q, p: max(100, abs(q) * 0.0021),

integer_positions=False,

progress_bar=True

)

tsmom_invvol_res = bt.run(tsmom_invvol_bt)

tsmom_ew_bt = bt.Backtest(

tsmom_ew_strat,

pdf,

initial_capital=50000000.0,

commissions=lambda q, p: max(100, abs(q) * 0.0021),

integer_positions=False,

progress_bar=True

)

tsmom_ew_res = bt.run(tsmom_ew_bt)

tsmom_invvol

0% [############################# ] 100% | ETA: 00:00:00tsmom_ew

0% [############################# ] 100% | ETA: 00:00:00

ax = plt.subplot()

ax.plot(tsmom_ew_res.prices.index,tsmom_ew_res.prices,label='EW')

pdf.plot(ax=ax)

ax.legend()

plt.legend()

plt.show()

tsmom_ew_res.stats

| tsmom_ew | |

|---|---|

| start | 2008-01-01 00:00:00 |

| end | 2017-08-29 00:00:00 |

| rf | 0.0 |

| total_return | 1.982933 |

| cagr | 0.119797 |

| max_drawdown | -0.103421 |

| calmar | 1.158343 |

| mtd | 0.017544 |

| three_month | 0.040722 |

| six_month | 0.079362 |

| ytd | 0.08107 |

| one_year | 0.100432 |

| three_year | 0.159895 |

| five_year | 0.172284 |

| ten_year | 0.119797 |

| incep | 0.119797 |

| daily_sharpe | 1.356727 |

| daily_sortino | 2.332895 |

| daily_mean | 0.112765 |

| daily_vol | 0.083116 |

| daily_skew | 0.029851 |

| daily_kurt | 0.96973 |

| best_day | 0.02107 |

| worst_day | -0.021109 |

| monthly_sharpe | 1.373241 |

| monthly_sortino | 2.966223 |

| monthly_mean | 0.118231 |

| monthly_vol | 0.086096 |

| monthly_skew | -0.059867 |

| monthly_kurt | 0.571064 |

| best_month | 0.070108 |

| worst_month | -0.064743 |

| yearly_sharpe | 1.741129 |

| yearly_sortino | inf |

| yearly_mean | 0.129033 |

| yearly_vol | 0.074109 |

| yearly_skew | 0.990397 |

| yearly_kurt | 1.973883 |

| best_year | 0.285249 |

| worst_year | 0.024152 |

| avg_drawdown | -0.015516 |

| avg_drawdown_days | 25.223214 |

| avg_up_month | 0.024988 |

| avg_down_month | -0.012046 |

| win_year_perc | 1.0 |

| twelve_month_win_perc | 0.971429 |

Trend Example 2¶

import numpy as np

import pandas as pd

import bt

import matplotlib.pyplot as plt

%matplotlib inline

np.random.seed(0)

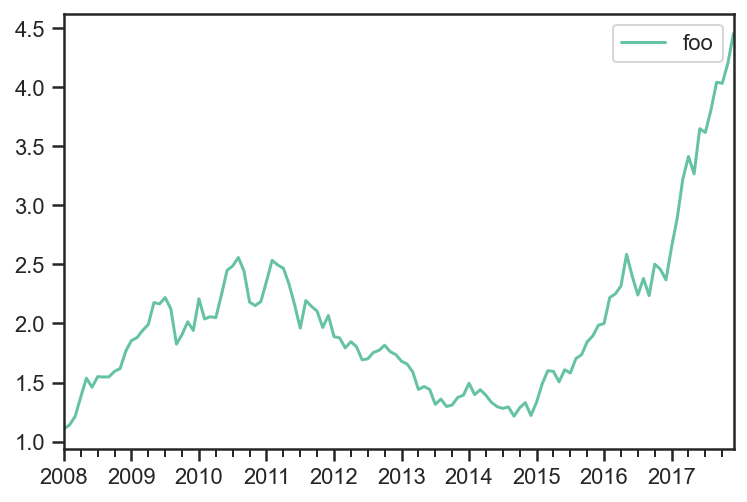

returns = np.random.normal(0.08/12,0.2/np.sqrt(12),12*10)

pdf = pd.DataFrame(

np.cumprod(1+returns),

index = pd.date_range(start="2008-01-01",periods=12*10,freq="m"),

columns=['foo']

)

pdf.plot();

runMonthlyAlgo = bt.algos.RunMonthly()

rebalAlgo = bt.algos.Rebalance()

class Signal(bt.Algo):

"""

Mostly copied from StatTotalReturn

Sets temp['Signal'] with total returns over a given period.

Sets the 'Signal' based on the total return of each

over a given lookback period.

Args:

* lookback (DateOffset): lookback period.

* lag (DateOffset): Lag interval. Total return is calculated in

the inteval [now - lookback - lag, now - lag]

Sets:

* stat

Requires:

* selected

"""

def __init__(self, lookback=pd.DateOffset(months=3),

lag=pd.DateOffset(days=0)):

super(Signal, self).__init__()

self.lookback = lookback

self.lag = lag

def __call__(self, target):

selected = 'foo'

t0 = target.now - self.lag

if target.universe[selected].index[0] > t0:

return False

prc = target.universe[selected].loc[t0 - self.lookback:t0]

trend = prc.iloc[-1]/prc.iloc[0] - 1

signal = trend > 0.

if signal:

target.temp['Signal'] = 1.

else:

target.temp['Signal'] = 0.

return True

signalAlgo = Signal(pd.DateOffset(months=12),pd.DateOffset(months=1))

class WeighFromSignal(bt.Algo):

"""

Sets temp['weights'] from the signal.

Sets:

* weights

Requires:

* selected

"""

def __init__(self):

super(WeighFromSignal, self).__init__()

def __call__(self, target):

selected = 'foo'

if target.temp['Signal'] is None:

raise(Exception('No Signal!'))

target.temp['weights'] = {selected : target.temp['Signal']}

return True

weighFromSignalAlgo = WeighFromSignal()

s = bt.Strategy(

'example1',

[

runMonthlyAlgo,

signalAlgo,

weighFromSignalAlgo,

rebalAlgo

]

)

t = bt.Backtest(s, pdf, integer_positions=False, progress_bar=True)

res = bt.run(t)

example1

0% [############################# ] 100% | ETA: 00:00:00

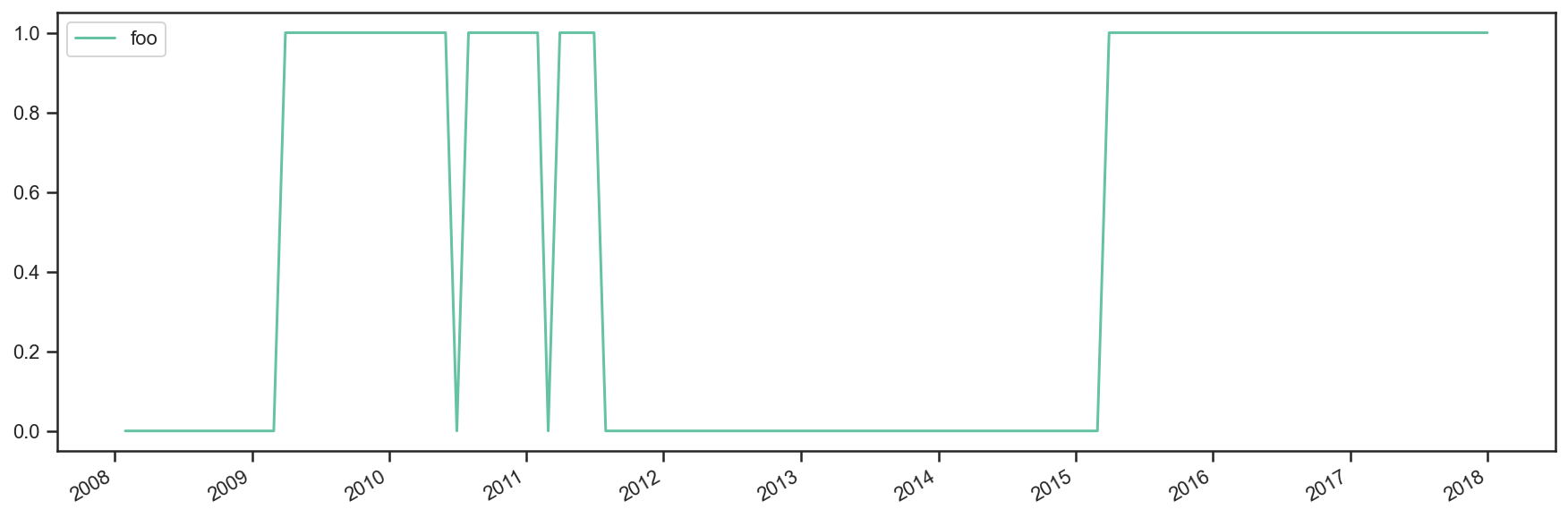

res.plot_security_weights();

t.positions

| foo | |

|---|---|

| 2008-01-30 | 0.000000 |

| 2008-01-31 | 0.000000 |

| 2008-02-29 | 0.000000 |

| 2008-03-31 | 0.000000 |

| 2008-04-30 | 0.000000 |

| ... | ... |

| 2017-08-31 | 631321.251898 |

| 2017-09-30 | 631321.251898 |

| 2017-10-31 | 631321.251898 |

| 2017-11-30 | 631321.251898 |

| 2017-12-31 | 631321.251898 |

121 rows × 1 columns

res.prices.tail()

| example1 | |

|---|---|

| 2017-08-31 | 240.302579 |

| 2017-09-30 | 255.046653 |

| 2017-10-31 | 254.464421 |

| 2017-11-30 | 265.182603 |

| 2017-12-31 | 281.069771 |

res.stats

| example1 | |

|---|---|

| start | 2008-01-30 00:00:00 |

| end | 2017-12-31 00:00:00 |

| rf | 0.0 |

| total_return | 1.810698 |

| cagr | 0.109805 |

| max_drawdown | -0.267046 |

| calmar | 0.411186 |

| mtd | 0.05991 |

| three_month | 0.102033 |

| six_month | 0.22079 |

| ytd | 0.879847 |

| one_year | 0.879847 |

| three_year | 0.406395 |

| five_year | 0.227148 |

| ten_year | 0.109805 |

| incep | 0.109805 |

| daily_sharpe | 3.299555 |

| daily_sortino | 6.352869 |

| daily_mean | 2.448589 |

| daily_vol | 0.742097 |

| daily_skew | 0.307861 |

| daily_kurt | 1.414455 |

| best_day | 0.137711 |

| worst_day | -0.14073 |

| monthly_sharpe | 0.723148 |

| monthly_sortino | 1.392893 |

| monthly_mean | 0.117579 |

| monthly_vol | 0.162594 |

| monthly_skew | 0.301545 |

| monthly_kurt | 1.379006 |

| best_month | 0.137711 |

| worst_month | -0.14073 |

| yearly_sharpe | 0.503939 |

| yearly_sortino | 5.019272 |

| yearly_mean | 0.14814 |

| yearly_vol | 0.293964 |

| yearly_skew | 2.317496 |

| yearly_kurt | 5.894955 |

| best_year | 0.879847 |

| worst_year | -0.088543 |

| avg_drawdown | -0.091255 |

| avg_drawdown_days | 369.714286 |

| avg_up_month | 0.064341 |

| avg_down_month | -0.012928 |

| win_year_perc | 0.555556 |

| twelve_month_win_perc | 0.46789 |

Strategy Combination¶

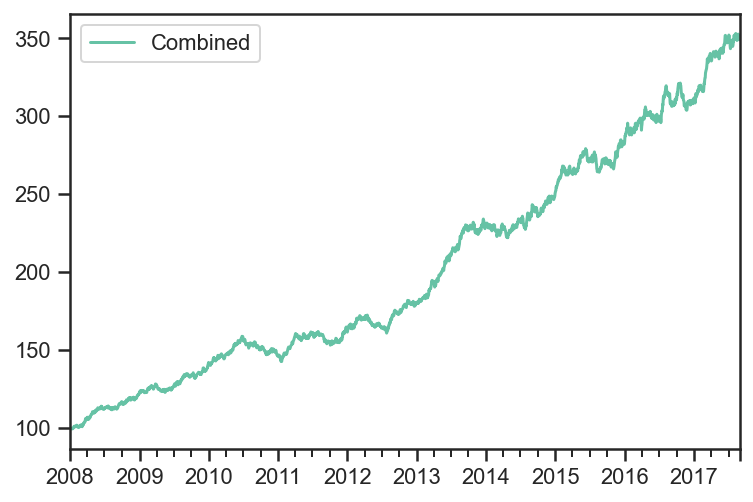

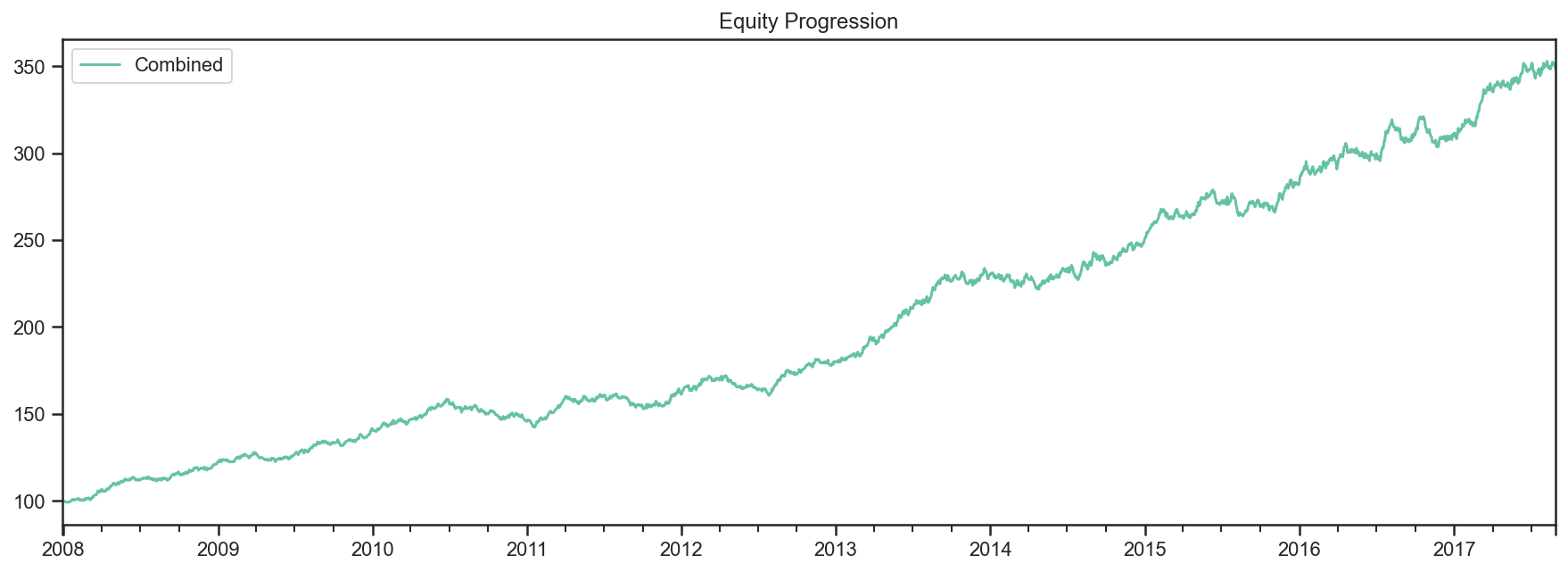

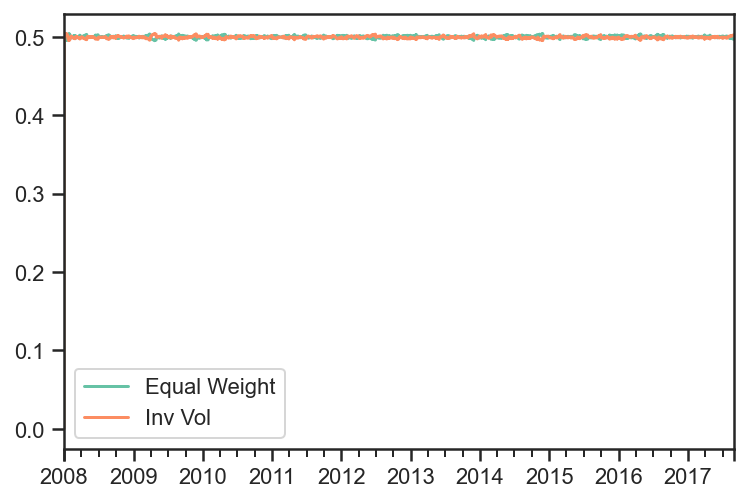

This notebook creates a parent strategy(combined) with 2 child strategies(Equal Weight, Inv Vol).

Alternatively, it creates the 2 child strategies, runs the backtest, combines the results, and creates a parent strategy using both of the backtests.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import ffn

import bt

%matplotlib inline

Create fake data¶

rf = 0.04

np.random.seed(1)

mus = np.random.normal(loc=0.05,scale=0.02,size=5) + rf

sigmas = (mus - rf)/0.3 + np.random.normal(loc=0.,scale=0.01,size=5)

num_years = 10

num_months_per_year = 12

num_days_per_month = 21

num_days_per_year = num_months_per_year*num_days_per_month

rdf = pd.DataFrame(

index = pd.date_range(

start="2008-01-02",

periods=num_years*num_months_per_year*num_days_per_month,

freq="B"

),

columns=['foo','bar','baz','fake1','fake2']

)

for i,mu in enumerate(mus):

sigma = sigmas[i]

rdf.iloc[:,i] = np.random.normal(

loc=mu/num_days_per_year,

scale=sigma/np.sqrt(num_days_per_year),

size=rdf.shape[0]

)

pdf = np.cumprod(1+rdf)*100

pdf.iloc[0,:] = 100

pdf.plot();

strategy_names = np.array(

[

'Equal Weight',

'Inv Vol'

]

)

runMonthlyAlgo = bt.algos.RunMonthly(

run_on_first_date=True,

run_on_end_of_period=True

)

selectAllAlgo = bt.algos.SelectAll()

rebalanceAlgo = bt.algos.Rebalance()

strats = []

tests = []

for i,s in enumerate(strategy_names):

if s == "Equal Weight":

wAlgo = bt.algos.WeighEqually()

elif s == "Inv Vol":

wAlgo = bt.algos.WeighInvVol()

strat = bt.Strategy(

str(s),

[

runMonthlyAlgo,

selectAllAlgo,

wAlgo,

rebalanceAlgo

]

)

strats.append(strat)

t = bt.Backtest(

strat,

pdf,

integer_positions = False,

progress_bar=False

)

tests.append(t)

combined_strategy = bt.Strategy(

'Combined',

algos = [

runMonthlyAlgo,

selectAllAlgo,

bt.algos.WeighEqually(),

rebalanceAlgo

],

children = [x.strategy for x in tests]

)

combined_test = bt.Backtest(

combined_strategy,

pdf,

integer_positions = False,

progress_bar = False

)

res = bt.run(combined_test)

res.prices.plot();

res.get_security_weights().plot();

In order to get the weights of each strategy, you can run each strategy, get the prices for each strategy, combine them into one price dataframe, run the combined strategy on the new data set.

strategy_names = np.array(

[

'Equal Weight',

'Inv Vol'

]

)

runMonthlyAlgo = bt.algos.RunMonthly(

run_on_first_date=True,

run_on_end_of_period=True

)

selectAllAlgo = bt.algos.SelectAll()

rebalanceAlgo = bt.algos.Rebalance()

strats = []

tests = []

results = []

for i,s in enumerate(strategy_names):

if s == "Equal Weight":

wAlgo = bt.algos.WeighEqually()

elif s == "Inv Vol":

wAlgo = bt.algos.WeighInvVol()

strat = bt.Strategy(

s,

[

runMonthlyAlgo,

selectAllAlgo,

wAlgo,

rebalanceAlgo

]

)

strats.append(strat)

t = bt.Backtest(

strat,

pdf,

integer_positions = False,

progress_bar=False

)

tests.append(t)

res = bt.run(t)

results.append(res)

fig, ax = plt.subplots(nrows=1,ncols=1)

for i,r in enumerate(results):

r.plot(ax=ax)

merged_prices_df = bt.merge(results[0].prices,results[1].prices)

combined_strategy = bt.Strategy(

'Combined',

algos = [

runMonthlyAlgo,

selectAllAlgo,

bt.algos.WeighEqually(),

rebalanceAlgo

]

)

combined_test = bt.Backtest(

combined_strategy,

merged_prices_df,

integer_positions = False,

progress_bar = False

)

res = bt.run(combined_test)

res.plot();

res.get_security_weights().plot();

Equally Weighted Risk Contributions Portfolio¶

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import ffn

import bt

%matplotlib inline

Create Fake Index Data¶

mean = np.array([0.05/252 + 0.02/252, 0.03/252 + 0.02/252])

volatility = np.array([0.2/np.sqrt(252), 0.05/np.sqrt(252)])

variance = np.power(volatility,2)

correlation = np.array(

[

[1, 0.25],

[0.25,1]

]

)

covariance = np.zeros((2,2))

for i in range(len(variance)):

for j in range(len(variance)):

covariance[i,j] = correlation[i,j]*volatility[i]*volatility[j]

covariance

array([[1.58730159e-04, 9.92063492e-06],

[9.92063492e-06, 9.92063492e-06]])

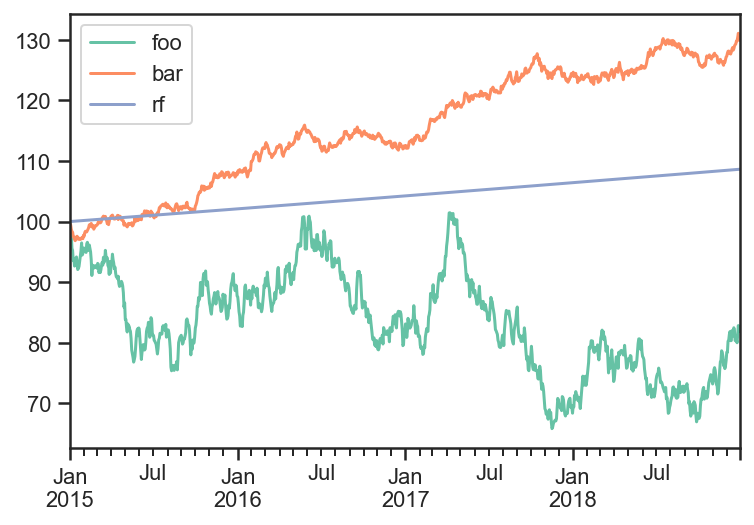

names = ['foo','bar','rf']

dates = pd.date_range(start='2015-01-01',end='2018-12-31', freq=pd.tseries.offsets.BDay())

n = len(dates)

rdf = pd.DataFrame(

np.zeros((n, len(names))),

index = dates,

columns = names

)

np.random.seed(1)

rdf.loc[:,['foo','bar']] = np.random.multivariate_normal(mean,covariance,size=n)

rdf['rf'] = 0.02/252

pdf = 100*np.cumprod(1+rdf)

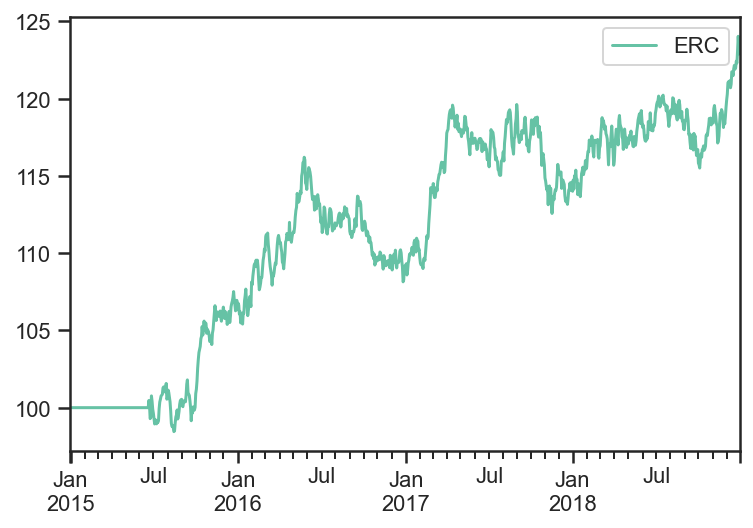

pdf.plot();

Build and run ERC Strategy¶

You can read more about ERC here. http://thierry-roncalli.com/download/erc.pdf

runAfterDaysAlgo = bt.algos.RunAfterDays(

20*6 + 1

)

selectTheseAlgo = bt.algos.SelectThese(['foo','bar'])

# algo to set the weights so each asset contributes the same amount of risk

# with data over the last 6 months excluding yesterday

weighERCAlgo = bt.algos.WeighERC(

lookback=pd.DateOffset(days=20*6),

covar_method='standard',

risk_parity_method='slsqp',

maximum_iterations=1000,

tolerance=1e-9,

lag=pd.DateOffset(days=1)

)

rebalAlgo = bt.algos.Rebalance()

strat = bt.Strategy(

'ERC',

[

runAfterDaysAlgo,

selectTheseAlgo,

weighERCAlgo,

rebalAlgo

]

)

backtest = bt.Backtest(

strat,

pdf,

integer_positions=False

)

res_target = bt.run(backtest)

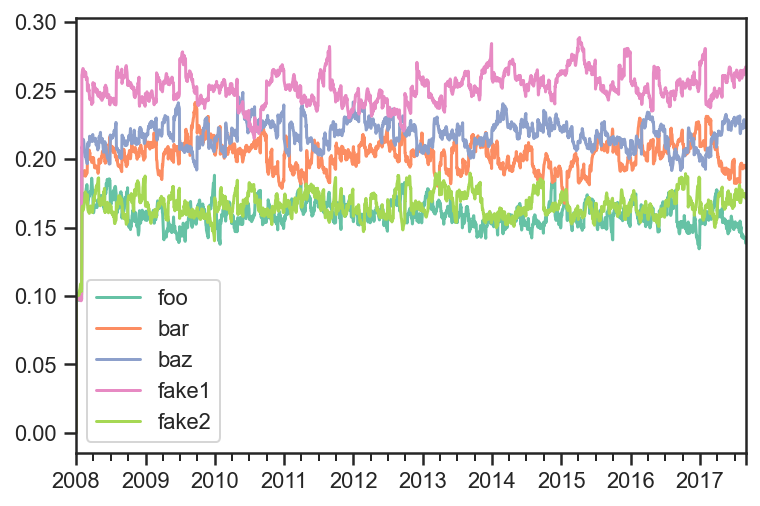

res_target.get_security_weights().plot();

res_target.prices.plot();

weights_target = res_target.get_security_weights().copy()

rolling_cov_target = pdf.loc[:,weights_target.columns].pct_change().rolling(window=252).cov()*252

trc_target = pd.DataFrame(

np.nan,

index = weights_target.index,

columns = weights_target.columns

)

for dt in pdf.index:

trc_target.loc[dt,:] = weights_target.loc[dt,:].values*(rolling_cov_target.loc[dt,:].values@weights_target.loc[dt,:].values)/np.sqrt(weights_target.loc[dt,:].values@rolling_cov_target.loc[dt,:].values@weights_target.loc[dt,:].values)

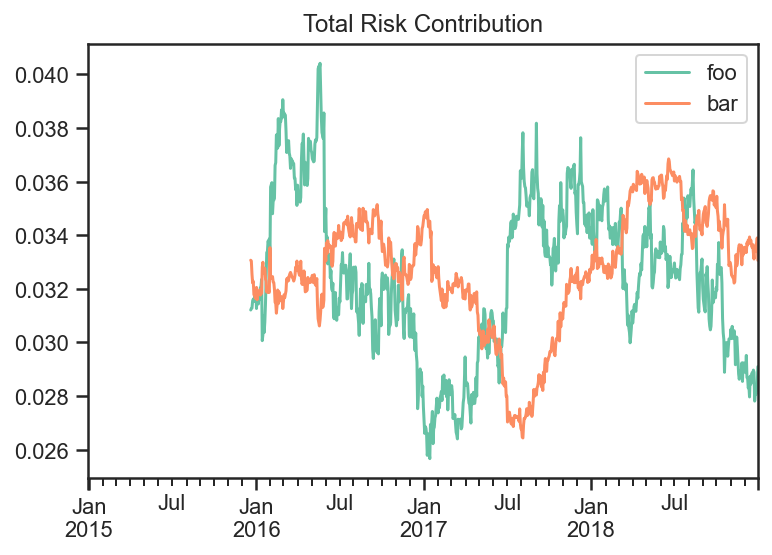

fig, ax = plt.subplots(nrows=1,ncols=1)

trc_target.plot(ax=ax)

ax.set_title('Total Risk Contribution')

ax.plot();

You can see the Total Risk Contribution is roughly equal from both assets.

Predicted Tracking Error Rebalance Portfolio¶

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import ffn

import bt

%matplotlib inline

Create Fake Index Data¶

names = ['foo','bar','rf']

dates = pd.date_range(start='2015-01-01',end='2018-12-31', freq=pd.tseries.offsets.BDay())

n = len(dates)

rdf = pd.DataFrame(

np.zeros((n, len(names))),

index = dates,

columns = names

)

np.random.seed(1)

rdf['foo'] = np.random.normal(loc = 0.1/252,scale=0.2/np.sqrt(252),size=n)

rdf['bar'] = np.random.normal(loc = 0.04/252,scale=0.05/np.sqrt(252),size=n)

rdf['rf'] = 0.

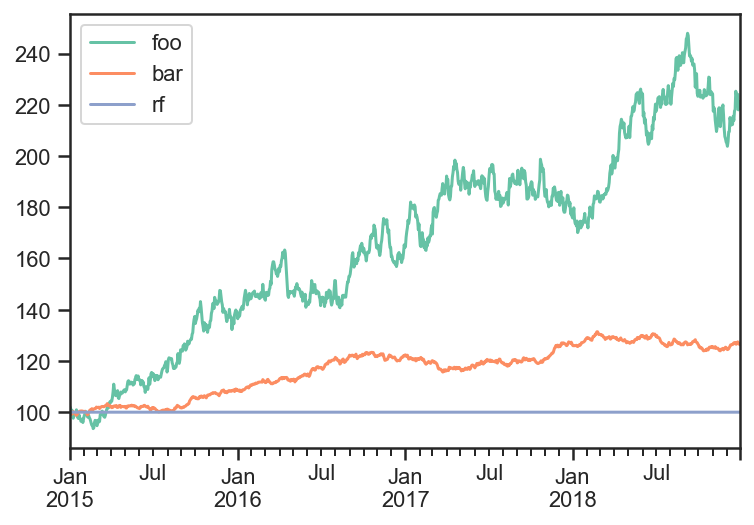

pdf = 100*np.cumprod(1+rdf)

pdf.plot();

Build and run Target Strategy¶

I will first run a strategy that rebalances everyday.

Then I will use those weights as target to rebalance to whenever the PTE is too high.

selectTheseAlgo = bt.algos.SelectThese(['foo','bar'])

# algo to set the weights to 1/vol contributions from each asset

# with data over the last 3 months excluding yesterday

weighInvVolAlgo = bt.algos.WeighInvVol(

lookback=pd.DateOffset(months=3),

lag=pd.DateOffset(days=1)

)

# algo to rebalance the current weights to weights set in target.temp

rebalAlgo = bt.algos.Rebalance()

# a strategy that rebalances daily to 1/vol weights

strat = bt.Strategy(

'Target',

[

selectTheseAlgo,

weighInvVolAlgo,

rebalAlgo

]

)

# set integer_positions=False when positions are not required to be integers(round numbers)

backtest = bt.Backtest(

strat,

pdf,

integer_positions=False

)

res_target = bt.run(backtest)

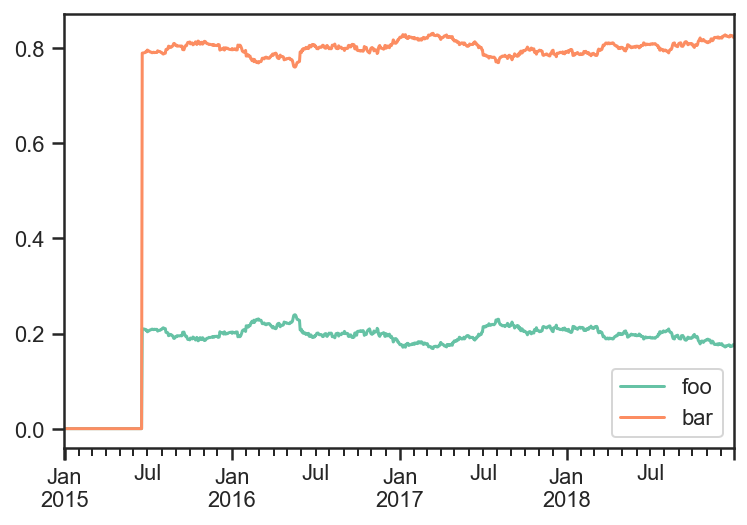

res_target.get_security_weights().plot();

Now use the PTE rebalance algo to trigger a rebalance whenever predicted tracking error is greater than 1%.

# algo to fire whenever predicted tracking error is greater than 1%

wdf = res_target.get_security_weights()

PTE_rebalance_Algo = bt.algos.PTE_Rebalance(

0.01,

wdf,

lookback=pd.DateOffset(months=3),

lag=pd.DateOffset(days=1),

covar_method='standard',

annualization_factor=252

)

selectTheseAlgo = bt.algos.SelectThese(['foo','bar'])

# algo to set the weights to 1/vol contributions from each asset

# with data over the last 12 months excluding yesterday

weighTargetAlgo = bt.algos.WeighTarget(

wdf

)

rebalAlgo = bt.algos.Rebalance()

# a strategy that rebalances monthly to specified weights

strat = bt.Strategy(

'PTE',

[

PTE_rebalance_Algo,

selectTheseAlgo,

weighTargetAlgo,

rebalAlgo

]

)

# set integer_positions=False when positions are not required to be integers(round numbers)

backtest = bt.Backtest(

strat,

pdf,

integer_positions=False

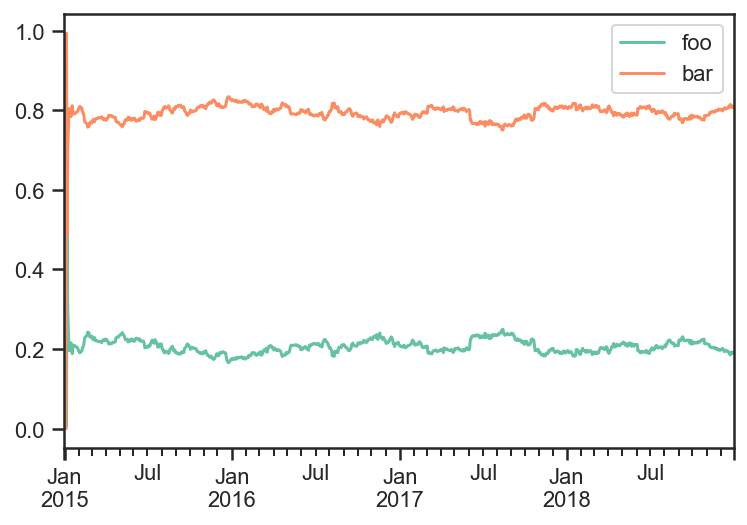

)

res_PTE = bt.run(backtest)

fig, ax = plt.subplots(nrows=1,ncols=1)

res_target.get_security_weights().plot(ax=ax)

realized_weights_df = res_PTE.get_security_weights()

realized_weights_df['PTE foo'] = realized_weights_df['foo']

realized_weights_df['PTE bar'] = realized_weights_df['bar']

realized_weights_df = realized_weights_df.loc[:,['PTE foo', 'PTE bar']]

realized_weights_df.plot(ax=ax)

ax.set_title('Target Weights vs PTE Weights')

ax.plot();

trans_df = pd.DataFrame(

index=res_target.prices.index,

columns=['Target','PTE']

)

transactions = res_target.get_transactions()

transactions = (transactions['quantity'] * transactions['price']).reset_index()

bar_mask = transactions.loc[:,'Security'] == 'bar'

foo_mask = transactions.loc[:,'Security'] == 'foo'

trans_df.loc[trans_df.index[4:],'Target'] = np.abs(transactions[bar_mask].iloc[:,2].values) + np.abs(transactions[foo_mask].iloc[:,2].values)

transactions = res_PTE.get_transactions()

transactions = (transactions['quantity'] * transactions['price']).reset_index()

bar_mask = transactions.loc[:,'Security'] == 'bar'

foo_mask = transactions.loc[:,'Security'] == 'foo'

trans_df.loc[transactions[bar_mask].iloc[:,0],'PTE'] = np.abs(transactions[bar_mask].iloc[:,2].values)

trans_df.loc[transactions[foo_mask].iloc[:,0],'PTE'] += np.abs(transactions[foo_mask].iloc[:,2].values)

trans_df = trans_df.fillna(0)

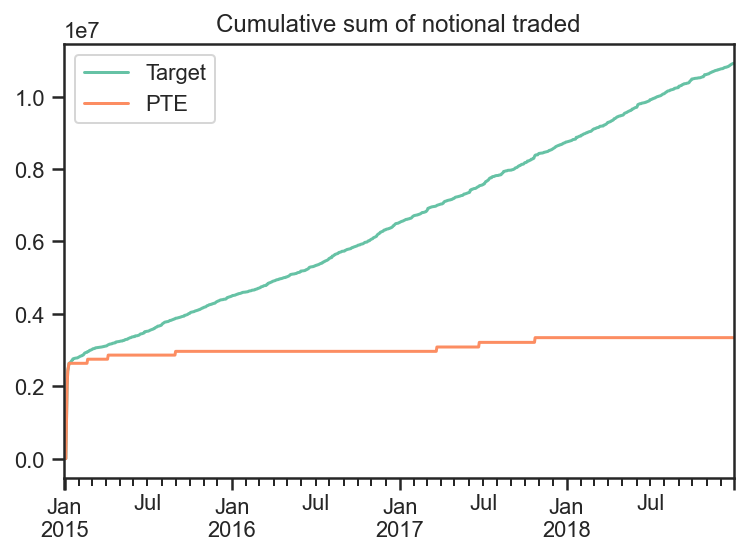

fig, ax = plt.subplots(nrows=1,ncols=1)

trans_df.cumsum().plot(ax=ax)

ax.set_title('Cumulative sum of notional traded')

ax.plot();

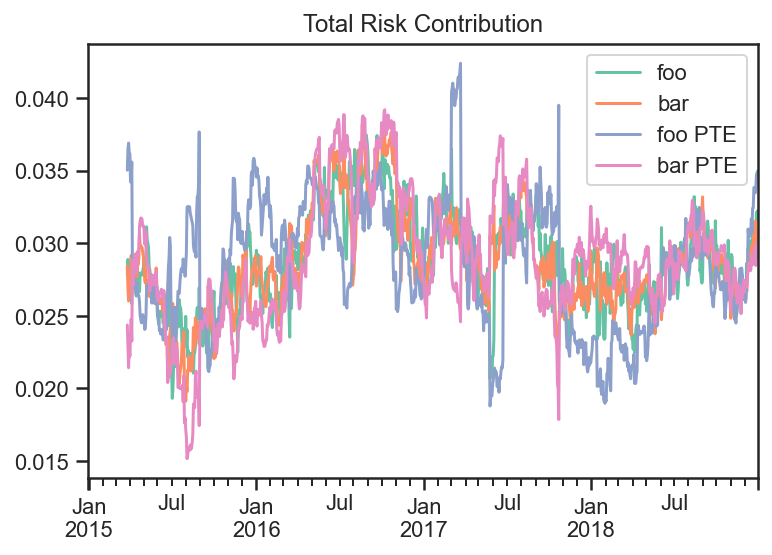

If we plot the total risk contribution of each asset class and divide by the total volatility, then we can see that both strategy’s contribute roughly similar amounts of volatility from both of the securities.

weights_target = res_target.get_security_weights()

rolling_cov_target = pdf.loc[:,weights_target.columns].pct_change().rolling(window=3*20).cov()*252

weights_PTE = res_PTE.get_security_weights().loc[:,weights_target.columns]

rolling_cov_PTE = pdf.loc[:,weights_target.columns].pct_change().rolling(window=3*20).cov()*252

trc_target = pd.DataFrame(

np.nan,

index = weights_target.index,

columns = weights_target.columns

)

trc_PTE = pd.DataFrame(

np.nan,

index = weights_PTE.index,

columns = [x + " PTE" for x in weights_PTE.columns]

)

for dt in pdf.index:

trc_target.loc[dt,:] = weights_target.loc[dt,:].values*(rolling_cov_target.loc[dt,:].values@weights_target.loc[dt,:].values)/np.sqrt(weights_target.loc[dt,:].values@rolling_cov_target.loc[dt,:].values@weights_target.loc[dt,:].values)

trc_PTE.loc[dt,:] = weights_PTE.loc[dt,:].values*(rolling_cov_PTE.loc[dt,:].values@weights_PTE.loc[dt,:].values)/np.sqrt(weights_PTE.loc[dt,:].values@rolling_cov_PTE.loc[dt,:].values@weights_PTE.loc[dt,:].values)

fig, ax = plt.subplots(nrows=1,ncols=1)

trc_target.plot(ax=ax)

trc_PTE.plot(ax=ax)

ax.set_title('Total Risk Contribution')

ax.plot();

Looking at the Target strategy’s and PTE strategy’s Total Risk they are very similar.

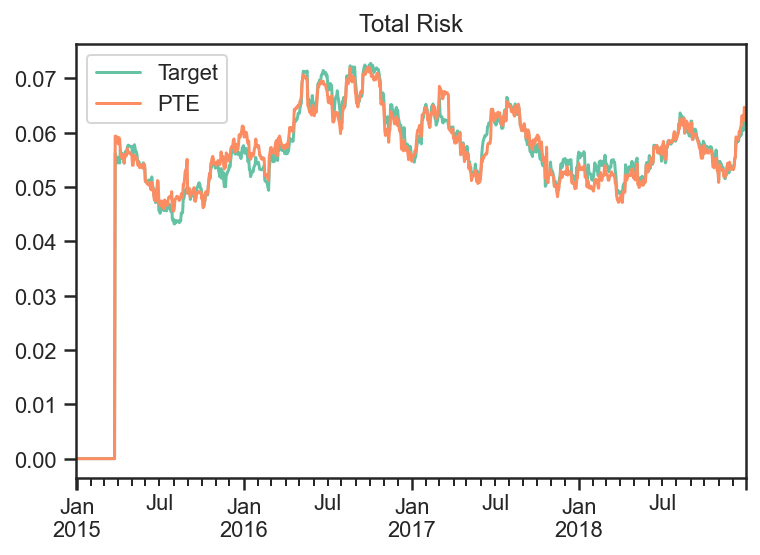

fig, ax = plt.subplots(nrows=1,ncols=1)

trc_target.sum(axis=1).plot(ax=ax,label='Target')

trc_PTE.sum(axis=1).plot(ax=ax,label='PTE')

ax.legend()

ax.set_title('Total Risk')

ax.plot();

transactions = res_PTE.get_transactions()

transactions = (transactions['quantity'] * transactions['price']).reset_index()

bar_mask = transactions.loc[:,'Security'] == 'bar'

dates_of_PTE_transactions = transactions[bar_mask].iloc[:,0]

dates_of_PTE_transactions

0 2015-01-06

2 2015-01-07

4 2015-01-08

6 2015-01-09

8 2015-01-12

10 2015-02-20

12 2015-04-07

14 2015-09-01

16 2017-03-23

18 2017-06-23

20 2017-10-24

Name: Date, dtype: datetime64[ns]

fig, ax = plt.subplots(nrows=1,ncols=1)

np.sum(np.abs(trc_target.values - trc_PTE.values))

#.abs().sum(axis=1).plot()

ax.set_title('Total Risk')

ax.plot(

trc_target.index,

np.sum(np.abs(trc_target.values - trc_PTE.values),axis=1),

label='PTE'

)

for i,dt in enumerate(dates_of_PTE_transactions):

if i == 0:

ax.axvline(x=dt,color='red',label='PTE Transaction')

else:

ax.axvline(x=dt,color='red')

ax.legend();

We can see the Predicted Tracking Error of the PTE Strategy with each transaction marked.

Fixed Income Examples¶

This example notebook illustrates some of the more sophisticated functionality of the package, especially related to fixed income securities and strategies. For fixed income strategies:

capital allocations are not necessary, and initial capital is not used

bankruptcy is disabled (as money can always be borrowed at some rate, potentially represented as another asset)

weights are based off notional_value rather than value. For fixed income securities, notional value is just the position. For non-fixed income securities (i.e. equities), it is the market value of the position.

strategy notional_value is always positive, equal to the sum of the magnitudes of the notional values of all its children

strategy price is computed from additive PNL returns per unit of notional_value, with a reference price of PAR

“rebalancing” the portfolio adjusts notionals rather than capital allocations based on weights

Further to the above characteristics of fixed income strategies, we also demonstrate the usage of the following features which arise in these types of use case:

Coupon paying securities (i.e. bonds)

Handing of security lifecycle such as new issues and maturity

Usage of “On-The-Run” instruments, and rolling of positions into the “new” on-the-run security at pre-defined times

Risk tracking/aggregation and hedging from pre-computed risk per unit notional

The notebook contains the following parts:

Setup

Market data generation

Rolling series of government bonds

Corporate bonds with spreads driven by a common factor

Example 1: Basic Strategies

Weigh all active corporate bond equally

Add hedging of interest rates risk with the on-the-run government bond

Example 2: Nested Strategies

One strategy buys the top N bonds, by yield

Another strategy sells the bottom N bonds, by yield

Parent strategy gives 50% weight to each of the above

Add hedges of remaining interest rates risk with the on-the-run government bond

Setup¶

import bt

import pandas as pd

from pandas.tseries.frequencies import to_offset

import numpy as np

np.random.seed(1234)

%matplotlib inline

# (Approximate) Price to yield calcs, and pvbp, for later use. Note we use clean price here.

def price_to_yield( p, ttm, coupon ):

return ( coupon + (100. - p)/ttm ) / ( ( 100. + p)/2. ) * 100

def yield_to_price( y, ttm, coupon ):

return (coupon + 100/ttm - 0.5 * y) / ( y/200 + 1/ttm)

def pvbp( y, ttm, coupon ):

return (yield_to_price( y + 0.01, ttm, coupon ) - yield_to_price( y, ttm, coupon ))

# Utility function to set data frame values to nan before the security has been issued or after it has matured

def censor( data, ref_data ):

for bond in data:

data.loc[ (data.index > ref_data['mat_date'][bond]) | (data.index < ref_data['issue_date'][bond]), bond] = np.NaN

return data.ffill(limit=1,axis=0) # Because bonds might mature during a gap in the index (i.e. on the weekend)

# Backtesting timeline setup

start_date = pd.Timestamp('2020-01-01')

end_date = pd.Timestamp('2022-01-01')

timeline = pd.date_range( start_date, end_date, freq='B')

Market Data Generation¶

# Government Bonds: Create synthetic data for a single series of rolling government bonds

# Reference Data

roll_freq = 'Q'

maturity = 10

coupon = 2.0

roll_dates = pd.date_range( start_date, end_date+to_offset(roll_freq), freq=roll_freq) # Go one period beyond the end date to be safe

issue_dates = roll_dates - roll_dates.freq

mat_dates = issue_dates + pd.offsets.DateOffset(years=maturity)

series_name = 'govt_10Y'

names = pd.Series(mat_dates).apply( lambda x : 'govt_%s' % x.strftime('%Y_%m'))

# Build a time series of OTR

govt_otr = pd.DataFrame( [ [ name for name, roll_date in zip(names, roll_dates) if roll_date >=d ][0] for d in timeline ],

index=timeline,

columns=[series_name])

# Create a data frame of reference data

govt_data = pd.DataFrame( {'mat_date':mat_dates, 'issue_date': issue_dates, 'roll_date':roll_dates}, index = names)

govt_data['coupon'] = coupon

# Create the "roll map"

govt_roll_map = govt_otr.copy()

govt_roll_map['target'] = govt_otr[series_name].shift(-1)

govt_roll_map = govt_roll_map[ govt_roll_map[series_name] != govt_roll_map['target']]

govt_roll_map['factor'] = 1.

govt_roll_map = govt_roll_map.reset_index().set_index(series_name).rename(columns={'index':'date'}).dropna()

# Market Data and Risk

govt_yield_initial = 2.0

govt_yield_vol = 1.

govt_yield = pd.DataFrame( columns = govt_data.index, index=timeline )

govt_yield_ts = (govt_yield_initial + np.cumsum( np.random.normal( 0., govt_yield_vol/np.sqrt(252), len(timeline)))).reshape(-1,1)

govt_yield.loc[:,:] = govt_yield_ts

govt_mat = pd.DataFrame( columns = govt_data.index, index=timeline, data=pd.NA ).astype('datetime64')

govt_mat.loc[:,:] = govt_data['mat_date'].values.T

govt_ttm = (govt_mat - timeline.values.reshape(-1,1))/pd.Timedelta('1Y')

govt_coupon = pd.DataFrame( columns = govt_data.index, index=timeline )

govt_coupon.loc[:,:] = govt_data['coupon'].values.T

govt_accrued = govt_coupon.multiply( timeline.to_series().diff()/pd.Timedelta('1Y'), axis=0 )

govt_accrued.iloc[0] = 0

govt_price = yield_to_price( govt_yield, govt_ttm, govt_coupon )

govt_price[ govt_ttm <= 0 ] = 100.

govt_price = censor(govt_price, govt_data)

govt_pvbp = pvbp( govt_yield, govt_ttm, govt_coupon)

govt_pvbp[ govt_ttm <= 0 ] = 0.

govt_pvbp = censor(govt_pvbp, govt_data)

/opt/homebrew/lib/python3.9/site-packages/IPython/core/interactiveshell.py:3397: FutureWarning: Units 'M', 'Y' and 'y' do not represent unambiguous timedelta values and will be removed in a future version

exec(code_obj, self.user_global_ns, self.user_ns)

# Corporate Bonds: Create synthetic data for a universe of corporate bonds

# Reference Data

n_corp = 50 # Number of corporate bonds to generate

avg_ttm = 10 # Average time to maturity, in years

coupon_mean = 5

coupon_std = 1.5

mat_dates = start_date + np.random.exponential(avg_ttm*365, n_corp).astype(int) * pd.offsets.Day()

issue_dates = np.minimum( mat_dates, end_date ) - np.random.exponential(avg_ttm*365, n_corp).astype(int) * pd.offsets.Day()

names = pd.Series( [ 'corp{:04d}'.format(i) for i in range(n_corp)])

coupons = np.random.normal( coupon_mean, coupon_std, n_corp ).round(3)

corp_data = pd.DataFrame( {'mat_date':mat_dates, 'issue_date': issue_dates, 'coupon':coupons}, index=names)

# Market Data and Risk

# Model: corporate yield = government yield + credit spread

# Model: credit spread changes = beta * common factor changes + idiosyncratic changes

corp_spread_initial = np.random.normal( 2, 1, len(corp_data) )

corp_betas_raw = np.random.normal( 1, 0.5, len(corp_data) )

corp_factor_vol = 0.5

corp_idio_vol = 0.5

corp_factor_ts = np.cumsum( np.random.normal( 0, corp_factor_vol/np.sqrt(252), len(timeline))).reshape(-1,1)

corp_idio_ts = np.cumsum( np.random.normal( 0, corp_idio_vol/np.sqrt(252), len(timeline))).reshape(-1,1)

corp_spread = corp_spread_initial + np.multiply( corp_factor_ts, corp_betas_raw ) + corp_idio_ts

corp_yield = govt_yield_ts + corp_spread

corp_yield = pd.DataFrame( columns = corp_data.index, index=timeline, data = corp_yield )

corp_mat = pd.DataFrame( columns = corp_data.index, index=timeline, data=start_date )

corp_mat.loc[:,:] = corp_data['mat_date'].values.T

corp_ttm = (corp_mat - timeline.values.reshape(-1,1))/pd.Timedelta('1Y')

corp_coupon = pd.DataFrame( columns = corp_data.index, index=timeline )

corp_coupon.loc[:,:] = corp_data['coupon'].values.T

corp_accrued = corp_coupon.multiply( timeline.to_series().diff()/pd.Timedelta('1Y'), axis=0 )

corp_accrued.iloc[0] = 0

corp_price = yield_to_price( corp_yield, corp_ttm, corp_coupon )

corp_price[ corp_ttm <= 0 ] = 100.

corp_price = censor(corp_price, corp_data)

corp_pvbp = pvbp( corp_yield, corp_ttm, corp_coupon)

corp_pvbp[ corp_ttm <= 0 ] = 0.

corp_pvbp = censor(corp_pvbp, corp_data)

bidoffer_bps = 5.

corp_bidoffer = -bidoffer_bps * corp_pvbp

corp_betas = pd.DataFrame( columns = corp_data.index, index=timeline )

corp_betas.loc[:,:] = corp_betas_raw

corp_betas = censor(corp_betas, corp_data)

/opt/homebrew/lib/python3.9/site-packages/IPython/core/interactiveshell.py:3397: FutureWarning: Units 'M', 'Y' and 'y' do not represent unambiguous timedelta values and will be removed in a future version

exec(code_obj, self.user_global_ns, self.user_ns)

Example 1: Basic Strategies¶

# Set up a strategy and a backtest

# The goal here is to define an equal weighted portfolio of corporate bonds,

# and to hedge the rates risk with the rolling series of government bonds

# Define Algo Stacks as the various building blocks

# Note that the order in which we execute these is extremely important

lifecycle_stack = bt.core.AlgoStack(

# Close any matured bond positions (including hedges)

bt.algos.ClosePositionsAfterDates( 'maturity' ),

# Roll government bond positions into the On The Run

bt.algos.RollPositionsAfterDates( 'govt_roll_map' ),

)

risk_stack = bt.AlgoStack(

# Specify how frequently to calculate risk

bt.algos.Or( [bt.algos.RunWeekly(),

bt.algos.RunMonthly()] ),

# Update the risk given any positions that have been put on so far in the current step

bt.algos.UpdateRisk( 'pvbp', history=1),

bt.algos.UpdateRisk( 'beta', history=1),

)

hedging_stack = bt.AlgoStack(

# Specify how frequently to hedge risk

bt.algos.RunMonthly(),

# Select the "alias" for the on-the-run government bond...

bt.algos.SelectThese( [series_name], include_no_data = True ),

# ... and then resolve it to the underlying security for the given date

bt.algos.ResolveOnTheRun( 'govt_otr' ),

# Hedge out the pvbp risk using the selected government bond

bt.algos.HedgeRisks( ['pvbp']),

# Need to update risk again after hedging so that it gets recorded correctly (post-hedges)

bt.algos.UpdateRisk( 'pvbp', history=True),

)

debug_stack = bt.core.AlgoStack(

# Specify how frequently to display debug info

bt.algos.RunMonthly(),

bt.algos.PrintInfo('Strategy {name} : {now}.\tNotional: {_notl_value:0.0f},\t Value: {_value:0.0f},\t Price: {_price:0.4f}'),

bt.algos.PrintRisk('Risk: \tPVBP: {pvbp:0.0f},\t Beta: {beta:0.0f}'),

)

trading_stack =bt.core.AlgoStack(

# Specify how frequently to rebalance the portfolio

bt.algos.RunMonthly(),

# Select instruments for rebalancing. Start with everything

bt.algos.SelectAll(),

# Prevent matured/rolled instruments from coming back into the mix

bt.algos.SelectActive(),

# Select only corp instruments

bt.algos.SelectRegex( 'corp' ),

# Specify how to weigh the securities

bt.algos.WeighEqually(),

# Set the target portfolio size

bt.algos.SetNotional( 'notional_value' ),

# Rebalance the portfolio

bt.algos.Rebalance()

)

govt_securities = [ bt.CouponPayingHedgeSecurity( name ) for name in govt_data.index]

corp_securities = [ bt.CouponPayingSecurity( name ) for name in corp_data.index ]

securities = govt_securities + corp_securities

base_strategy = bt.FixedIncomeStrategy('BaseStrategy', [ lifecycle_stack, bt.algos.Or( [trading_stack, risk_stack, debug_stack ] ) ], children = securities)

hedged_strategy = bt.FixedIncomeStrategy('HedgedStrategy', [ lifecycle_stack, bt.algos.Or( [trading_stack, risk_stack, hedging_stack, debug_stack ] ) ], children = securities)

#Collect all the data for the strategies

# Here we use clean prices as the data and accrued as the coupon. Could alternatively use dirty prices and cashflows.

data = pd.concat( [ govt_price, corp_price ], axis=1) / 100. # Because we need prices per unit notional

additional_data = { 'coupons' : pd.concat([govt_accrued, corp_accrued], axis=1) / 100.,

'bidoffer' : corp_bidoffer/100.,

'notional_value' : pd.Series( data=1e6, index=data.index ),

'maturity' : pd.concat([govt_data, corp_data], axis=0).rename(columns={"mat_date": "date"}),

'govt_roll_map' : govt_roll_map,

'govt_otr' : govt_otr,

'unit_risk' : {'pvbp' : pd.concat( [ govt_pvbp, corp_pvbp] ,axis=1)/100.,

'beta' : corp_betas * corp_pvbp / 100.},

}

base_test = bt.Backtest( base_strategy, data, 'BaseBacktest',

initial_capital = 0,

additional_data = additional_data )

hedge_test = bt.Backtest( hedged_strategy, data, 'HedgedBacktest',

initial_capital = 0,

additional_data = additional_data)

out = bt.run( base_test, hedge_test )

Strategy BaseStrategy : 2020-01-01 00:00:00. Notional: 1000000, Value: -1644, Price: 99.8356

Risk: PVBP: -658, Beta: -659

Strategy BaseStrategy : 2020-02-03 00:00:00. Notional: 1000000, Value: -6454, Price: 99.3546

Risk: PVBP: -642, Beta: -643

Strategy BaseStrategy : 2020-03-02 00:00:00. Notional: 1000000, Value: -26488, Price: 97.3512

Risk: PVBP: -611, Beta: -613

Strategy BaseStrategy : 2020-04-01 00:00:00. Notional: 1000000, Value: -20295, Price: 97.9705

Risk: PVBP: -607, Beta: -608

Strategy BaseStrategy : 2020-05-01 00:00:00. Notional: 1000000, Value: -43692, Price: 95.6308

Risk: PVBP: -573, Beta: -574

Strategy BaseStrategy : 2020-06-01 00:00:00. Notional: 1000000, Value: -41095, Price: 95.8905

Risk: PVBP: -566, Beta: -566

Strategy BaseStrategy : 2020-07-01 00:00:00. Notional: 1000000, Value: -15724, Price: 98.4985

Risk: PVBP: -609, Beta: -608

Strategy BaseStrategy : 2020-08-03 00:00:00. Notional: 1000000, Value: -22308, Price: 97.8400

Risk: PVBP: -587, Beta: -594

Strategy BaseStrategy : 2020-09-01 00:00:00. Notional: 1000000, Value: 12832, Price: 101.4263

Risk: PVBP: -644, Beta: -650

Strategy BaseStrategy : 2020-10-01 00:00:00. Notional: 1000000, Value: 35263, Price: 103.6965

Risk: PVBP: -683, Beta: -680

Strategy BaseStrategy : 2020-11-02 00:00:00. Notional: 1000000, Value: 3702, Price: 100.5404

Risk: PVBP: -638, Beta: -646

Strategy BaseStrategy : 2020-12-01 00:00:00. Notional: 1000000, Value: -18534, Price: 98.3168

Risk: PVBP: -606, Beta: -613

Strategy BaseStrategy : 2021-01-01 00:00:00. Notional: 1000000, Value: -11054, Price: 99.0648

Risk: PVBP: -603, Beta: -609

Strategy BaseStrategy : 2021-02-01 00:00:00. Notional: 1000000, Value: -16424, Price: 98.5537

Risk: PVBP: -602, Beta: -609

Strategy BaseStrategy : 2021-03-01 00:00:00. Notional: 1000000, Value: -34462, Price: 96.6943

Risk: PVBP: -603, Beta: -586

Strategy BaseStrategy : 2021-04-01 00:00:00. Notional: 1000000, Value: -23533, Price: 97.7872

Risk: PVBP: -603, Beta: -586

Strategy BaseStrategy : 2021-05-03 00:00:00. Notional: 1000000, Value: -27024, Price: 97.4381

Risk: PVBP: -590, Beta: -574

Strategy BaseStrategy : 2021-06-01 00:00:00. Notional: 1000000, Value: -50723, Price: 95.0682

Risk: PVBP: -558, Beta: -541

Strategy BaseStrategy : 2021-07-01 00:00:00. Notional: 1000000, Value: -52714, Price: 94.8690

Risk: PVBP: -547, Beta: -528

Strategy BaseStrategy : 2021-08-02 00:00:00. Notional: 1000000, Value: -53039, Price: 94.8067

Risk: PVBP: -550, Beta: -531

Strategy BaseStrategy : 2021-09-01 00:00:00. Notional: 1000000, Value: -39027, Price: 96.2079

Risk: PVBP: -550, Beta: -524

Strategy BaseStrategy : 2021-10-01 00:00:00. Notional: 1000000, Value: -2051, Price: 99.9002

Risk: PVBP: -588, Beta: -561

Strategy BaseStrategy : 2021-11-01 00:00:00. Notional: 1000000, Value: -8616, Price: 99.2438

Risk: PVBP: -573, Beta: -544

Strategy BaseStrategy : 2021-12-01 00:00:00. Notional: 1000000, Value: 53520, Price: 105.6538

Risk: PVBP: -656, Beta: -623

Strategy HedgedStrategy : 2020-01-01 00:00:00. Notional: 1000000, Value: -1644, Price: 99.8356

Risk: PVBP: 0, Beta: -659

Strategy HedgedStrategy : 2020-02-03 00:00:00. Notional: 1000000, Value: -10996, Price: 98.9004

Risk: PVBP: 0, Beta: -643

Strategy HedgedStrategy : 2020-03-02 00:00:00. Notional: 1000000, Value: -16765, Price: 98.3235

Risk: PVBP: 0, Beta: -613

Strategy HedgedStrategy : 2020-04-01 00:00:00. Notional: 1000000, Value: -21649, Price: 97.8351

Risk: PVBP: -0, Beta: -608

Strategy HedgedStrategy : 2020-05-01 00:00:00. Notional: 1000000, Value: -33399, Price: 96.6601

Risk: PVBP: 0, Beta: -574

Strategy HedgedStrategy : 2020-06-01 00:00:00. Notional: 1000000, Value: -22927, Price: 97.7073

Risk: PVBP: -0, Beta: -566

Strategy HedgedStrategy : 2020-07-01 00:00:00. Notional: 1000000, Value: -14965, Price: 98.5366

Risk: PVBP: -0, Beta: -608

Strategy HedgedStrategy : 2020-08-03 00:00:00. Notional: 1000000, Value: 5092, Price: 100.5423

Risk: PVBP: -0, Beta: -594

Strategy HedgedStrategy : 2020-09-01 00:00:00. Notional: 1000000, Value: 22278, Price: 102.2828

Risk: PVBP: 0, Beta: -650

Strategy HedgedStrategy : 2020-10-01 00:00:00. Notional: 1000000, Value: 13903, Price: 101.4286

Risk: PVBP: -0, Beta: -680

Strategy HedgedStrategy : 2020-11-02 00:00:00. Notional: 1000000, Value: 12081, Price: 101.2464

Risk: PVBP: -0, Beta: -646

Strategy HedgedStrategy : 2020-12-01 00:00:00. Notional: 1000000, Value: 10531, Price: 101.0914

Risk: PVBP: -0, Beta: -613

Strategy HedgedStrategy : 2021-01-01 00:00:00. Notional: 1000000, Value: 12144, Price: 101.2528

Risk: PVBP: 0, Beta: -609

Strategy HedgedStrategy : 2021-02-01 00:00:00. Notional: 1000000, Value: 15903, Price: 101.6469

Risk: PVBP: -0, Beta: -609

Strategy HedgedStrategy : 2021-03-01 00:00:00. Notional: 1000000, Value: 11958, Price: 101.2204

Risk: PVBP: 0, Beta: -586

Strategy HedgedStrategy : 2021-04-01 00:00:00. Notional: 1000000, Value: 28170, Price: 102.8417

Risk: PVBP: -0, Beta: -586

Strategy HedgedStrategy : 2021-05-03 00:00:00. Notional: 1000000, Value: 34561, Price: 103.4807

Risk: PVBP: 0, Beta: -574

Strategy HedgedStrategy : 2021-06-01 00:00:00. Notional: 1000000, Value: 29233, Price: 102.9479

Risk: PVBP: -0, Beta: -541

Strategy HedgedStrategy : 2021-07-01 00:00:00. Notional: 1000000, Value: 10323, Price: 101.0569

Risk: PVBP: 0, Beta: -528

Strategy HedgedStrategy : 2021-08-02 00:00:00. Notional: 1000000, Value: 14539, Price: 101.4646

Risk: PVBP: 0, Beta: -531

Strategy HedgedStrategy : 2021-09-01 00:00:00. Notional: 1000000, Value: 10754, Price: 101.0860

Risk: PVBP: 0, Beta: -524

Strategy HedgedStrategy : 2021-10-01 00:00:00. Notional: 1000000, Value: 32502, Price: 103.2515

Risk: PVBP: -0, Beta: -561

Strategy HedgedStrategy : 2021-11-01 00:00:00. Notional: 1000000, Value: 24506, Price: 102.4519

Risk: PVBP: -0, Beta: -544

Strategy HedgedStrategy : 2021-12-01 00:00:00. Notional: 1000000, Value: 42093, Price: 104.2905

Risk: PVBP: -0, Beta: -623

# Extract Tear Sheet for base backtest

stats = out['BaseBacktest']

stats.display()

Stats for BaseBacktest from 2019-12-31 00:00:00 - 2021-12-31 00:00:00

Annual risk-free rate considered: 0.00%

Summary:

Total Return Sharpe CAGR Max Drawdown

-------------- -------- ------ --------------

2.34% 0.19 1.16% -10.64%

Annualized Returns:

mtd 3m 6m ytd 1y 3y 5y 10y incep.

------ ----- ----- ----- ----- ----- ---- ----- --------

-3.06% 1.45% 8.12% 3.43% 3.43% 1.16% - - 1.16%

Periodic:

daily monthly yearly

------ ------- --------- --------

sharpe 0.19 0.18 0.38

mean 1.38% 1.49% 1.19%

vol 7.26% 8.35% 3.17%

skew 0.16 0.75 -

kurt 0.52 0.70 -

best 1.59% 6.32% 3.43%

worst -1.44% -3.29% -1.05%

Drawdowns:

max avg # days

------- ------ --------

-10.64% -2.59% 79.22

Misc:

--------------- ------

avg. up month 1.88%

avg. down month -1.63%

up year % 50.00%

12m up % 57.14%

--------------- ------

# Extract Tear Sheet for hedged backtest

stats = out['HedgedBacktest']

stats.display()

Stats for HedgedBacktest from 2019-12-31 00:00:00 - 2021-12-31 00:00:00

Annual risk-free rate considered: 0.00%

Summary:

Total Return Sharpe CAGR Max Drawdown

-------------- -------- ------ --------------

3.51% 0.41 1.74% -3.87%

Annualized Returns:

mtd 3m 6m ytd 1y 3y 5y 10y incep.

------ ------ ----- ----- ----- ----- ---- ----- --------

-0.47% -0.30% 2.29% 2.46% 2.46% 1.74% - - 1.74%

Periodic:

daily monthly yearly

------ ------- --------- --------

sharpe 0.41 0.43 1.71

mean 1.75% 1.81% 1.74%

vol 4.26% 4.22% 1.02%

skew -0.17 0.67 -

kurt 0.21 -0.46 -

best 0.69% 2.82% 2.46%

worst -1.07% -1.62% 1.02%

Drawdowns:

max avg # days

------ ------ --------

-3.87% -1.02% 49.57

Misc:

--------------- -------

avg. up month 1.25%

avg. down month -0.78%

up year % 100.00%

12m up % 85.71%

--------------- -------

# Total PNL time series values

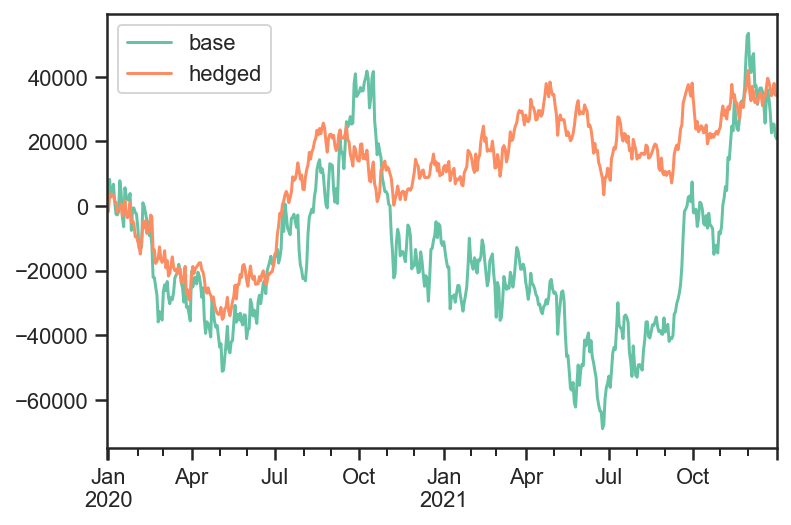

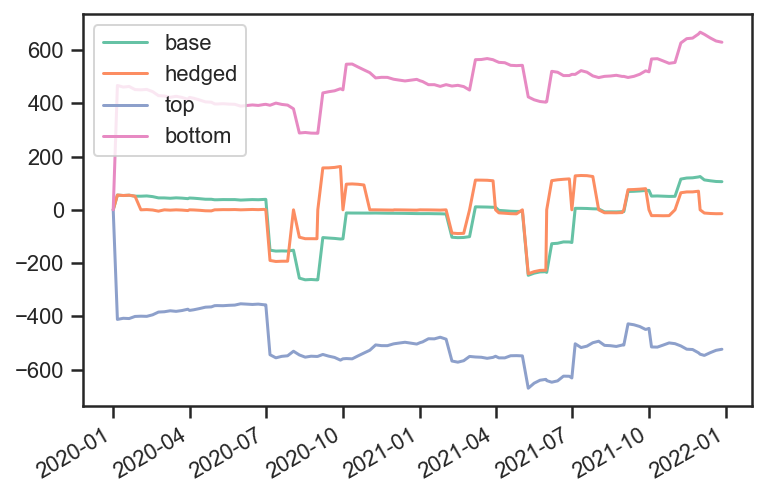

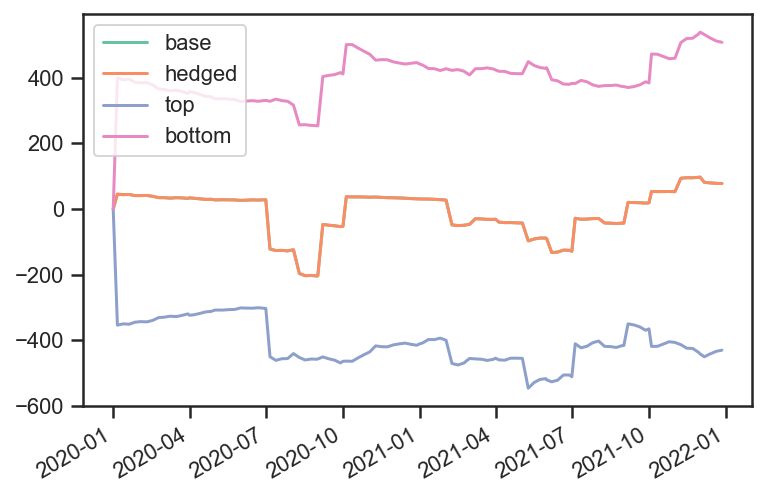

pd.DataFrame( {'base':base_test.strategy.values, 'hedged':hedge_test.strategy.values} ).plot();

# Total risk time series values

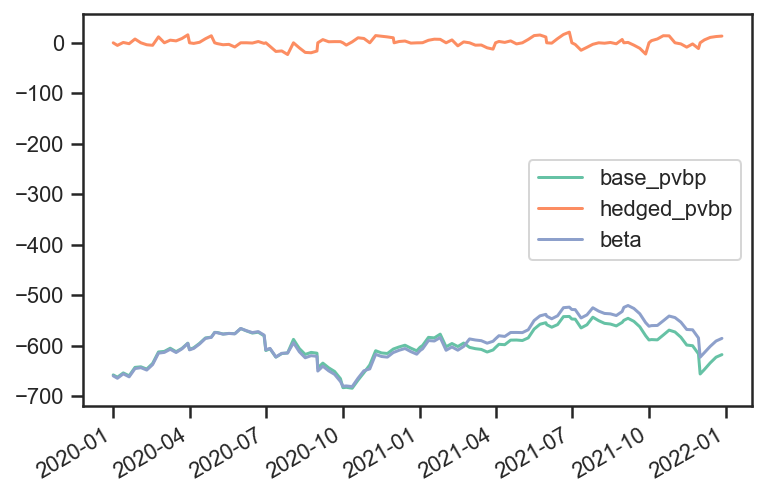

pd.DataFrame( {'base_pvbp':base_test.strategy.risks['pvbp'],

'hedged_pvbp':hedge_test.strategy.risks['pvbp'],

'beta':hedge_test.strategy.risks['beta']} ).dropna().plot();

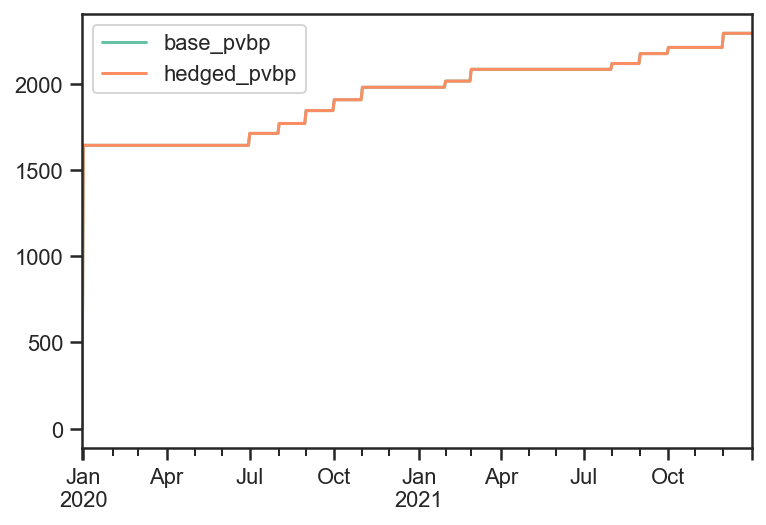

# Total bid/offer paid (same for both strategies)

pd.DataFrame( {'base_pvbp':base_test.strategy.bidoffers_paid,

'hedged_pvbp':hedge_test.strategy.bidoffers_paid }).cumsum().dropna().plot();

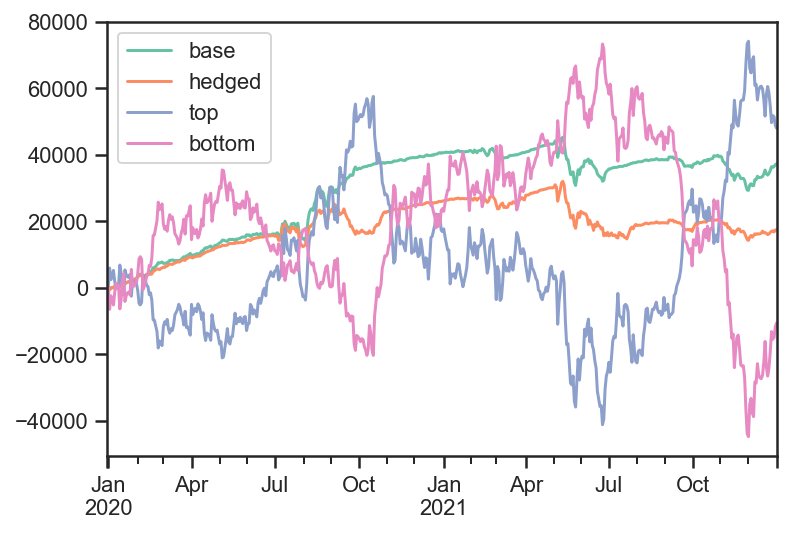

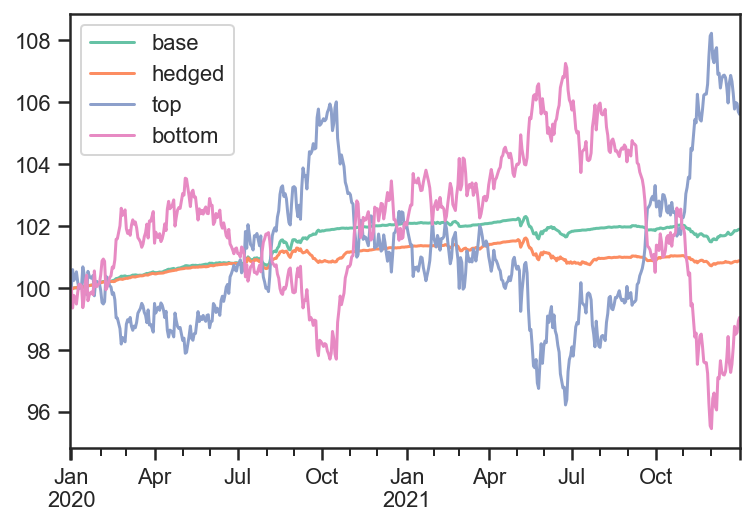

Example 2: Nested Strategies¶

# Set up a more complex strategy and a backtest

# The goal of the more complex strategy is to define two sub-strategies of corporate bonds

# - Highest yield bonds

# - Lowest yield bonds

# Then we will go long the high yield bonds, short the low yield bonds in equal weight

# Lastly we will hedge the rates risk with the government bond

govt_securities = [ bt.CouponPayingHedgeSecurity( name ) for name in govt_data.index]

corp_securities = [ bt.CouponPayingSecurity( name ) for name in corp_data.index ]

def get_algos( n, sort_descending ):

''' Helper function to return the algos for long or short portfolio, based on top n yields'''

return [

# Close any matured bond positions

bt.algos.ClosePositionsAfterDates( 'corp_maturity' ),

# Specify how frequenty to rebalance

bt.algos.RunMonthly(),

# Select instruments for rebalancing. Start with everything

bt.algos.SelectAll(),

# Prevent matured/rolled instruments from coming back into the mix

bt.algos.SelectActive(),

# Set the stat to be used for selection

bt.algos.SetStat( 'corp_yield' ),

# Select the top N yielding bonds

bt.algos.SelectN( n, sort_descending, filter_selected=True ),

# Specify how to weigh the securities

bt.algos.WeighEqually(),

bt.algos.ScaleWeights(1. if sort_descending else -1.), # Determine long/short

# Set the target portfolio size

bt.algos.SetNotional( 'notional_value' ),

# Rebalance the portfolio

bt.algos.Rebalance(),

]

bottom_algos = []

top_strategy = bt.FixedIncomeStrategy('TopStrategy', get_algos( 10, True ), children = corp_securities)

bottom_strategy = bt.FixedIncomeStrategy('BottomStrategy',get_algos( 10, False ), children = corp_securities)

risk_stack = bt.AlgoStack(

# Specify how frequently to calculate risk

bt.algos.Or( [bt.algos.RunWeekly(),

bt.algos.RunMonthly()] ),

# Update the risk given any positions that have been put on so far in the current step

bt.algos.UpdateRisk( 'pvbp', history=2),

bt.algos.UpdateRisk( 'beta', history=2),

)

hedging_stack = bt.AlgoStack(

# Close any matured hedge positions (including hedges)

bt.algos.ClosePositionsAfterDates( 'govt_maturity' ),

# Roll government bond positions into the On The Run

bt.algos.RollPositionsAfterDates( 'govt_roll_map' ),

# Specify how frequently to hedge risk

bt.algos.RunMonthly(),

# Select the "alias" for the on-the-run government bond...

bt.algos.SelectThese( [series_name], include_no_data = True ),

# ... and then resolve it to the underlying security for the given date

bt.algos.ResolveOnTheRun( 'govt_otr' ),

# Hedge out the pvbp risk using the selected government bond

bt.algos.HedgeRisks( ['pvbp']),

# Need to update risk again after hedging so that it gets recorded correctly (post-hedges)

bt.algos.UpdateRisk( 'pvbp', history=2),

)

debug_stack = bt.core.AlgoStack(

# Specify how frequently to display debug info

bt.algos.RunMonthly(),

bt.algos.PrintInfo('{now}: End {name}\tNotional: {_notl_value:0.0f},\t Value: {_value:0.0f},\t Price: {_price:0.4f}'),

bt.algos.PrintRisk('Risk: \tPVBP: {pvbp:0.0f},\t Beta: {beta:0.0f}'),

)

trading_stack =bt.core.AlgoStack(

# Specify how frequently to rebalance the portfolio of sub-strategies

bt.algos.RunOnce(),

# Specify how to weigh the sub-strategies

bt.algos.WeighSpecified( TopStrategy=0.5, BottomStrategy=-0.5),

# Rebalance the portfolio

bt.algos.Rebalance()

)

children = [ top_strategy, bottom_strategy ] + govt_securities

base_strategy = bt.FixedIncomeStrategy('BaseStrategy', [ bt.algos.Or( [trading_stack, risk_stack, debug_stack ] ) ], children = children)

hedged_strategy = bt.FixedIncomeStrategy('HedgedStrategy', [ bt.algos.Or( [trading_stack, risk_stack, hedging_stack, debug_stack ] ) ], children = children)

# Here we use clean prices as the data and accrued as the coupon. Could alternatively use dirty prices and cashflows.

data = pd.concat( [ govt_price, corp_price ], axis=1) / 100. # Because we need prices per unit notional

additional_data = { 'coupons' : pd.concat([govt_accrued, corp_accrued], axis=1) / 100., # Because we need coupons per unit notional

'notional_value' : pd.Series( data=1e6, index=data.index ),

'govt_maturity' : govt_data.rename(columns={"mat_date": "date"}),

'corp_maturity' : corp_data.rename(columns={"mat_date": "date"}),

'govt_roll_map' : govt_roll_map,

'govt_otr' : govt_otr,

'corp_yield' : corp_yield,

'unit_risk' : {'pvbp' : pd.concat( [ govt_pvbp, corp_pvbp] ,axis=1)/100.,

'beta' : corp_betas * corp_pvbp / 100.},

}

base_test = bt.Backtest( base_strategy, data, 'BaseBacktest',

initial_capital = 0,

additional_data = additional_data)

hedge_test = bt.Backtest( hedged_strategy, data, 'HedgedBacktest',

initial_capital = 0,

additional_data = additional_data)

out = bt.run( base_test, hedge_test )

2020-01-01 00:00:00: End BaseStrategy Notional: 0, Value: 0, Price: 100.0000

Risk: PVBP: 0, Beta: 0

2020-02-03 00:00:00: End BaseStrategy Notional: 2000000, Value: 3277, Price: 100.1639

Risk: PVBP: 51, Beta: 41

2020-03-02 00:00:00: End BaseStrategy Notional: 2000000, Value: 7297, Price: 100.3649

Risk: PVBP: 45, Beta: 34

2020-04-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 9336, Price: 100.4668

Risk: PVBP: 44, Beta: 34

2020-05-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 13453, Price: 100.6727

Risk: PVBP: 38, Beta: 28

2020-06-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 15887, Price: 100.7943

Risk: PVBP: 37, Beta: 26

2020-07-01 00:00:00: End BaseStrategy Notional: 1800000, Value: 16024, Price: 100.8010

Risk: PVBP: 39, Beta: 28

2020-08-03 00:00:00: End BaseStrategy Notional: 2000000, Value: 14785, Price: 100.7391

Risk: PVBP: -152, Beta: -124

2020-09-01 00:00:00: End BaseStrategy Notional: 1800000, Value: 30310, Price: 101.5550

Risk: PVBP: -263, Beta: -204

2020-10-01 00:00:00: End BaseStrategy Notional: 1900000, Value: 35915, Price: 101.8430

Risk: PVBP: -109, Beta: -53

2020-11-02 00:00:00: End BaseStrategy Notional: 2000000, Value: 37649, Price: 101.9297

Risk: PVBP: -12, Beta: 36

2020-12-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 39045, Price: 101.9995

Risk: PVBP: -13, Beta: 34

2021-01-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 40569, Price: 102.0758

Risk: PVBP: -14, Beta: 31

2021-02-01 00:00:00: End BaseStrategy Notional: 1900000, Value: 41228, Price: 102.1094

Risk: PVBP: -16, Beta: 27

2021-03-01 00:00:00: End BaseStrategy Notional: 1900000, Value: 38916, Price: 101.9868

Risk: PVBP: -101, Beta: -47

2021-04-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 40755, Price: 102.0788

Risk: PVBP: 9, Beta: -31

2021-05-03 00:00:00: End BaseStrategy Notional: 2000000, Value: 43290, Price: 102.2055

Risk: PVBP: -6, Beta: -43

2021-06-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 35947, Price: 101.8384

Risk: PVBP: -235, Beta: -91

2021-07-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 35671, Price: 101.8246

Risk: PVBP: -123, Beta: -129

2021-08-02 00:00:00: End BaseStrategy Notional: 2000000, Value: 37756, Price: 101.9288

Risk: PVBP: 3, Beta: -29

2021-09-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 38434, Price: 101.9627

Risk: PVBP: -7, Beta: -43

2021-10-01 00:00:00: End BaseStrategy Notional: 1900000, Value: 37082, Price: 101.8966

Risk: PVBP: 73, Beta: 19

2021-11-01 00:00:00: End BaseStrategy Notional: 2000000, Value: 39526, Price: 102.0187

Risk: PVBP: 51, Beta: 53

2021-12-01 00:00:00: End BaseStrategy Notional: 1900000, Value: 29228, Price: 101.4826

Risk: PVBP: 125, Beta: 97

2020-01-01 00:00:00: End HedgedStrategy Notional: 0, Value: 0, Price: 100.0000

Risk: PVBP: 0, Beta: 0

2020-02-03 00:00:00: End HedgedStrategy Notional: 2000000, Value: 3277, Price: 100.1639

Risk: PVBP: 0, Beta: 41

2020-03-02 00:00:00: End HedgedStrategy Notional: 2000000, Value: 6159, Price: 100.3079

Risk: PVBP: 0, Beta: 34

2020-04-01 00:00:00: End HedgedStrategy Notional: 2000000, Value: 9008, Price: 100.4504

Risk: PVBP: 0, Beta: 34

2020-05-01 00:00:00: End HedgedStrategy Notional: 2000000, Value: 12274, Price: 100.6137

Risk: PVBP: 0, Beta: 28

2020-06-01 00:00:00: End HedgedStrategy Notional: 2000000, Value: 14189, Price: 100.7094

Risk: PVBP: 0, Beta: 26

2020-07-01 00:00:00: End HedgedStrategy Notional: 1800000, Value: 15451, Price: 100.7752

Risk: PVBP: 0, Beta: 28

2020-08-03 00:00:00: End HedgedStrategy Notional: 2000000, Value: 12494, Price: 100.6273

Risk: PVBP: 0, Beta: -124

2020-09-01 00:00:00: End HedgedStrategy Notional: 1800000, Value: 23384, Price: 101.1967

Risk: PVBP: 0, Beta: -204

2020-10-01 00:00:00: End HedgedStrategy Notional: 1900000, Value: 16414, Price: 100.8372

Risk: PVBP: -0, Beta: -53

2020-11-02 00:00:00: End HedgedStrategy Notional: 2000000, Value: 22887, Price: 101.1609

Risk: PVBP: 0, Beta: 36

2020-12-01 00:00:00: End HedgedStrategy Notional: 2000000, Value: 24681, Price: 101.2506

Risk: PVBP: 0, Beta: 34