bt - Flexible Backtesting for Python¶

What is bt?¶

bt is a flexible backtesting framework for Python used to test quantitative

trading strategies. Backtesting is the process of testing a strategy over a given

data set. This framework allows you to easily create strategies that mix and match

different Algos. It aims to foster the creation of easily testable, re-usable and

flexible blocks of strategy logic to facilitate the rapid development of complex

trading strategies.

The goal: to save quants from re-inventing the wheel and let them focus on the important part of the job - strategy development.

bt is coded in Python and joins a vibrant and rich ecosystem for data analysis. Numerous libraries exist for machine learning, signal processing and statistics and can be leveraged to avoid re-inventing the wheel - something that happens all too often when using other languages that don’t have the same wealth of high-quality, open-source projects.

bt is built atop ffn - a financial function library for Python. Check it out!

A Quick Example¶

Here is a quick taste of bt:

import bt

%matplotlib inline

A Simple Strategy Backtest¶

Let’s create a simple strategy. We will create a monthly rebalanced, long-only strategy where we place equal weights on each asset in our universe of assets.

First, we will download some data. By default, bt.get (alias for ffn.get) downloads the Adjusted Close from Yahoo! Finance. We will download some data starting on January 1, 2010 for the purposes of this demo.

# fetch some data

data = bt.get('spy,agg', start='2010-01-01')

print(data.head())

spy agg

Date

2010-01-04 89.225410 74.942825

2010-01-05 89.461586 75.283791

2010-01-06 89.524574 75.240227

2010-01-07 89.902473 75.153221

2010-01-08 90.201691 75.196724

Once we have our data, we will create our strategy. The Strategy object contains the strategy logic by combining various Algos.

# create the strategy

s = bt.Strategy('s1', [bt.algos.RunMonthly(),

bt.algos.SelectAll(),

bt.algos.WeighEqually(),

bt.algos.Rebalance()])

Finally, we will create a Backtest, which is the logical combination of a strategy with a data set.

Once this is done, we can run the backtest and analyze the results.

# create a backtest and run it

test = bt.Backtest(s, data)

res = bt.run(test)

Now we can analyze the results of our backtest. The Result object is a thin wrapper around ffn.GroupStats that adds some helper methods.

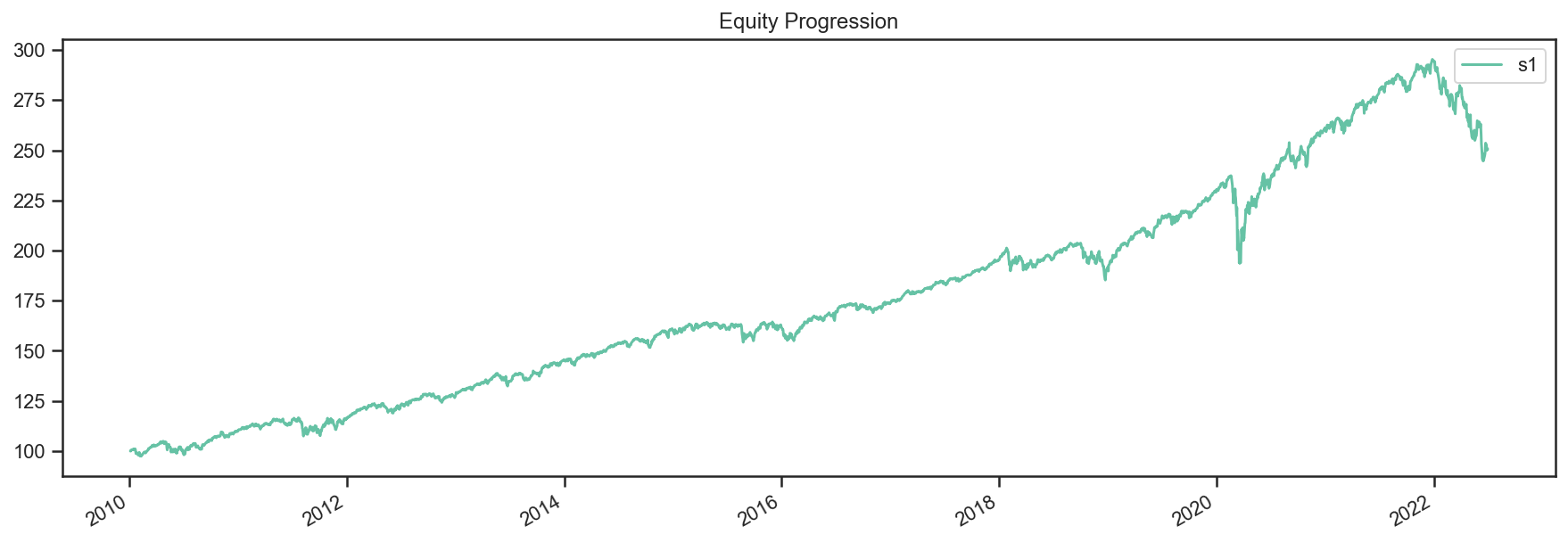

# first let's see an equity curve

res.plot();

# ok and what about some stats?

res.display()

Stat s1

------------------- ----------

Start 2010-01-03

End 2022-07-01

Risk-free rate 0.00%

Total Return 150.73%

Daily Sharpe 0.90

Daily Sortino 1.35

CAGR 7.64%

Max Drawdown -18.42%

Calmar Ratio 0.41

MTD 0.18%

3m -10.33%

6m -14.84%

YTD -14.84%

1Y -10.15%

3Y (ann.) 5.12%

5Y (ann.) 6.44%

10Y (ann.) 7.36%

Since Incep. (ann.) 7.64%

Daily Sharpe 0.90

Daily Sortino 1.35

Daily Mean (ann.) 7.74%

Daily Vol (ann.) 8.62%

Daily Skew -0.98

Daily Kurt 16.56

Best Day 4.77%

Worst Day -6.63%

Monthly Sharpe 1.06

Monthly Sortino 1.91

Monthly Mean (ann.) 7.81%

Monthly Vol (ann.) 7.36%

Monthly Skew -0.39

Monthly Kurt 1.59

Best Month 7.57%

Worst Month -6.44%

Yearly Sharpe 0.81

Yearly Sortino 1.75

Yearly Mean 7.48%

Yearly Vol 9.17%

Yearly Skew -1.34

Yearly Kurt 2.28

Best Year 19.64%

Worst Year -14.84%

Avg. Drawdown -0.84%

Avg. Drawdown Days 13.23

Avg. Up Month 1.70%

Avg. Down Month -1.80%

Win Year % 83.33%

Win 12m % 93.57%

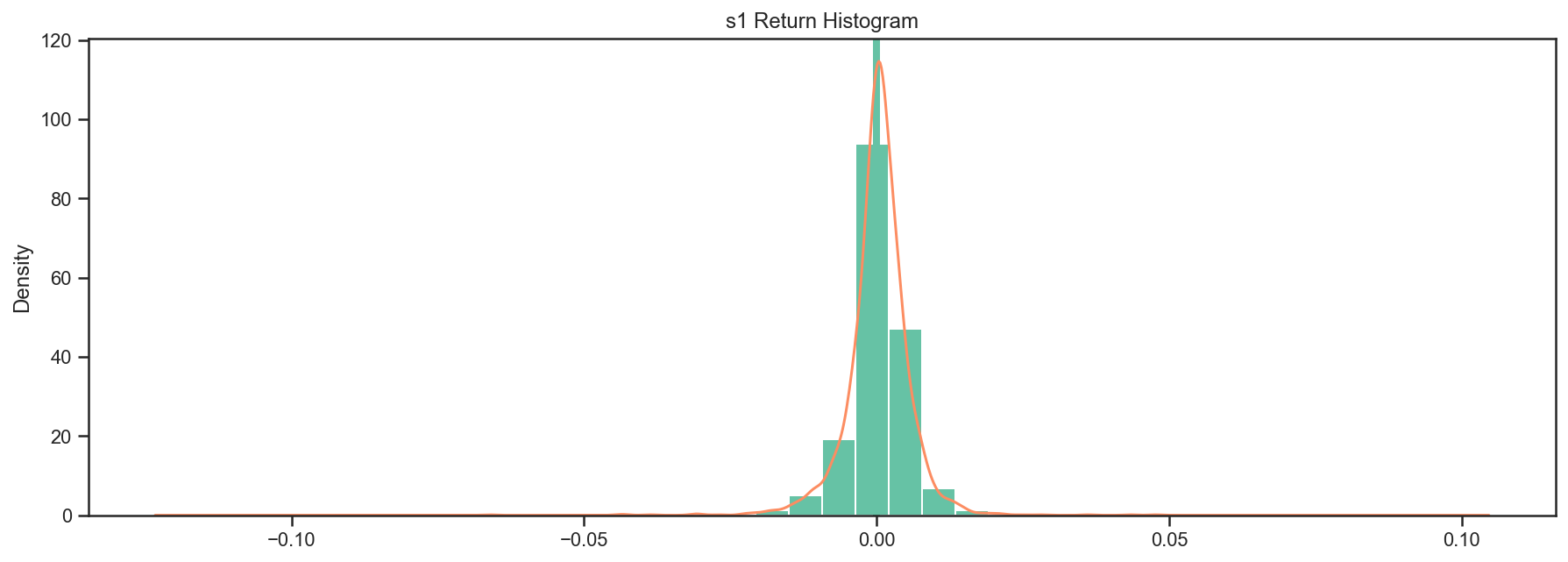

# ok and how does the return distribution look like?

res.plot_histogram()

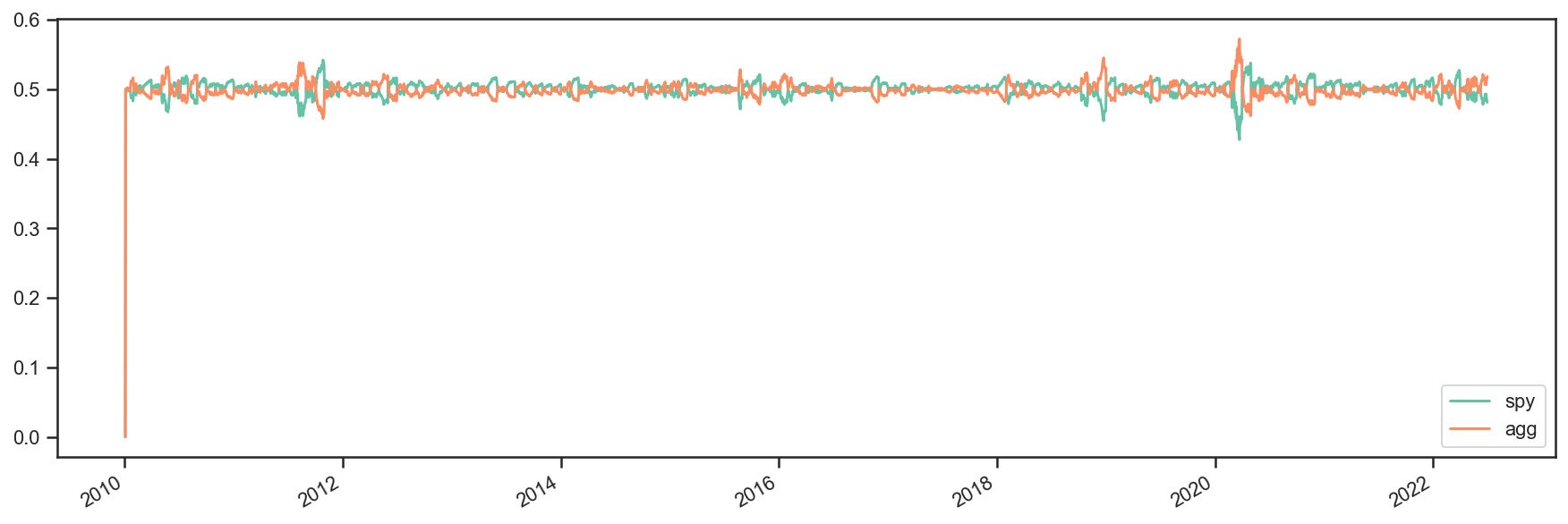

# and just to make sure everything went along as planned, let's plot the security weights over time

res.plot_security_weights()

Modifying a Strategy¶

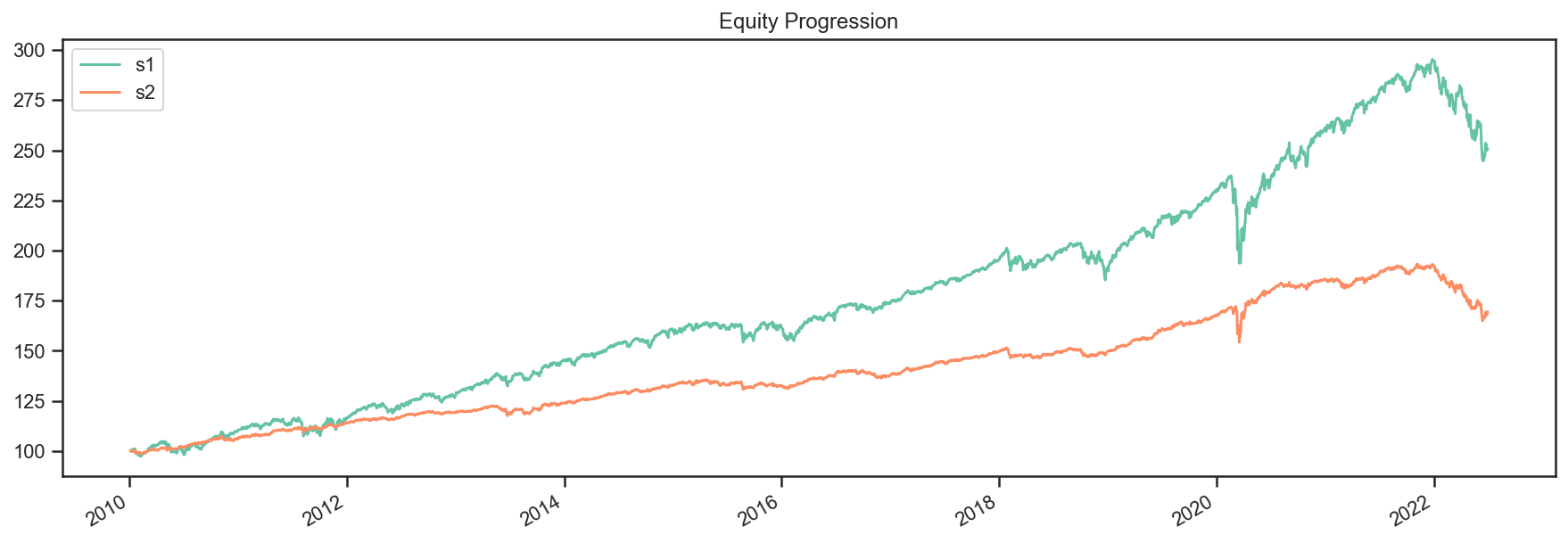

Now what if we ran this strategy weekly and also used some risk parity style approach by using weights that are proportional to the inverse of each asset’s volatility? Well, all we have to do is plug in some different algos. See below:

# create our new strategy

s2 = bt.Strategy('s2', [bt.algos.RunWeekly(),

bt.algos.SelectAll(),

bt.algos.WeighInvVol(),

bt.algos.Rebalance()])

# now let's test it with the same data set. We will also compare it with our first backtest.

test2 = bt.Backtest(s2, data)

# we include test here to see the results side-by-side

res2 = bt.run(test, test2)

res2.plot();

res2.display()

Stat s1 s2

------------------- ---------- ----------

Start 2010-01-03 2010-01-03

End 2022-07-01 2022-07-01

Risk-free rate 0.00% 0.00%

Total Return 150.73% 69.58%

Daily Sharpe 0.90 0.96

Daily Sortino 1.35 1.41

CAGR 7.64% 4.32%

Max Drawdown -18.42% -14.62%

Calmar Ratio 0.41 0.30

MTD 0.18% 0.38%

3m -10.33% -6.88%

6m -14.84% -12.00%

YTD -14.84% -12.00%

1Y -10.15% -10.03%

3Y (ann.) 5.12% 1.84%

5Y (ann.) 6.44% 3.35%

10Y (ann.) 7.36% 3.76%

Since Incep. (ann.) 7.64% 4.32%

Daily Sharpe 0.90 0.96

Daily Sortino 1.35 1.41

Daily Mean (ann.) 7.74% 4.33%

Daily Vol (ann.) 8.62% 4.50%

Daily Skew -0.98 -2.21

Daily Kurt 16.56 46.12

Best Day 4.77% 2.84%

Worst Day -6.63% -4.66%

Monthly Sharpe 1.06 1.13

Monthly Sortino 1.91 1.87

Monthly Mean (ann.) 7.81% 4.40%

Monthly Vol (ann.) 7.36% 3.89%

Monthly Skew -0.39 -1.06

Monthly Kurt 1.59 3.92

Best Month 7.57% 4.05%

Worst Month -6.44% -5.04%

Yearly Sharpe 0.81 0.65

Yearly Sortino 1.75 1.19

Yearly Mean 7.48% 4.13%

Yearly Vol 9.17% 6.31%

Yearly Skew -1.34 -1.48

Yearly Kurt 2.28 3.37

Best Year 19.64% 11.71%

Worst Year -14.84% -12.00%

Avg. Drawdown -0.84% -0.48%

Avg. Drawdown Days 13.23 13.68

Avg. Up Month 1.70% 0.90%

Avg. Down Month -1.80% -0.93%

Win Year % 83.33% 83.33%

Win 12m % 93.57% 91.43%

As you can see, the strategy logic is easy to understand and more importantly, easy to modify. The idea of using simple, composable Algos to create strategies is one of the core building blocks of bt.

Features¶

- Tree Structure

The tree structure facilitates the construction and composition of complex algorithmic trading strategies that are modular and re-usable. Furthermore, each tree

Nodehas its ownprice indexthat can be used by Algos to determine a Node’s allocation.

- Algorithm Stacks

AlgosandAlgoStacksare another core feature that facilitate the creation of modular and re-usable strategy logic. Due to their modularity, these logic blocks are also easier to test - an important step in building robust financial solutions.

- Transaction Cost Modeling

Through the use of a commission function and instrument-specific, time-varying bid/offer spreads passed to the

Backtest.

- Fixed Income

Strategies can include coupon-paying instruments such as bonds, unfunded instruments such as swaps, holding costs, and the option for notional weighting. These are extensions of the tree structure.

- Charting and Reporting

bt also provides many useful charting functions that help visualize backtest results. We also plan to add more charts, tables and report formats in the future, such as automatically generated PDF reports.

- Detailed Statistics

Furthermore, bt calculates a bunch of stats relating to a backtest and offers a quick way to compare these various statistics across many different backtests via

Results'display methods.

Roadmap¶

Future development efforts will focus on:

- Speed

Due to the flexible nature of bt, a trade-off had to be made between usability and performance. Usability will always be the priority, but we do wish to enhance the performance as much as possible.

- Algos

We will also be developing more algorithms as time goes on. We also encourage anyone to contribute their own algos as well.

- Charting and Reporting

This is another area we wish to constantly improve on as reporting is an important aspect of the job. Charting and reporting also facilitate finding bugs in strategy logic.