Quickstart¶

Here is a quick rundown of ffn’s capabilities. For a more complete guide, read the source, or check out the API docs.

import ffn

%matplotlib inline

Data Retrieval¶

The main method for data retrieval is the get function. The get function uses a data provider to download data from an external service and packs that data into a pandas DataFrame for further manipulation.

Note

You should note that upon import ffn modifies the pandas.core.base.PandasObject to provide added functionality to pandas objects, including DataFrames.

data = ffn.get('agg,hyg,spy,eem,efa', start='2010-01-01', end='2014-01-01')

print(data.head())

agg hyg spy eem efa

Date

2010-01-04 74.942818 43.466671 89.225403 33.181232 38.846069

2010-01-05 75.283783 43.672871 89.461578 33.422070 38.880318

2010-01-06 75.240242 43.785816 89.524582 33.491989 39.044666

2010-01-07 75.153183 43.962566 89.902481 33.297764 38.894009

2010-01-08 75.196701 44.031300 90.201675 33.561905 39.202148

By default, the data is downloaded from Yahoo! Finance and the Adjusted Close is used as the security’s price. Other data sources are also available and you may select other fields as well. Fields are specified by using the following format: {ticker}:{field}. So, if we want to get the Open, High, Low, Close for aapl, we would do the following:

print(ffn.get('aapl:Open,aapl:High,aapl:Low,aapl:Close', start='2010-01-01', end='2014-01-01').head())

aaplopen aaplhigh aapllow aaplclose

Date

2010-01-04 7.622500 7.660714 7.585000 7.643214

2010-01-05 7.664286 7.699643 7.616071 7.656429

2010-01-06 7.656429 7.686786 7.526786 7.534643

2010-01-07 7.562500 7.571429 7.466071 7.520714

2010-01-08 7.510714 7.571429 7.466429 7.570714

The default data provider is ffn.data.web(). This is basically just a thin wrapper around pandas’ pandas.io.data provider. Please refer to the appropriate docs for more info (data sources, etc.). The ffn.data.csv() provider is also available when we want to load data from a local file. In this case, we can tell ffn.data.get() to use the csv provider. In this case, we also want to merge this new data with the existing data we downloaded earlier. Therefore, we will provide the data object as the existing argument, and the new data will be merged into the existing DataFrame.

data = ffn.get('dbc', provider=ffn.data.csv, path='test_data.csv', existing=data)

print(data.head())

agg hyg spy eem efa dbc

Date

2010-01-04 74.942818 43.466671 89.225403 33.181232 38.846069 25.24

2010-01-05 75.283783 43.672871 89.461578 33.422070 38.880318 25.27

2010-01-06 75.240242 43.785816 89.524582 33.491989 39.044666 25.72

2010-01-07 75.153183 43.962566 89.902481 33.297764 38.894009 25.40

2010-01-08 75.196701 44.031300 90.201675 33.561905 39.202148 25.38

As we can see above, the dbc column was added to the DataFrame. Internally, get is using the function ffn.merge, which is useful when you want to merge TimeSeries and DataFrames together. We plan on adding many more data sources over time. If you know your way with Python and would like to contribute a data provider, please feel free to submit a pull request - contributions are always welcome!

Data Manipulation¶

Now that we have some data, let’s start manipulating it. In quantitative finance, we are often interested in the returns of a given time series. Let’s calculate the returns by simply calling the to_returns or to_log_returns extension methods.

returns = data.to_log_returns().dropna()

print(returns.head())

agg hyg spy eem efa dbc

Date

2010-01-05 0.004539 0.004733 0.002643 0.007232 0.000881 0.001188

2010-01-06 -0.000579 0.002583 0.000704 0.002090 0.004218 0.017651

2010-01-07 -0.001158 0.004029 0.004212 -0.005816 -0.003866 -0.012520

2010-01-08 0.000579 0.001562 0.003322 0.007901 0.007891 -0.000788

2010-01-11 -0.000772 -0.000893 0.001395 -0.002085 0.008176 -0.003157

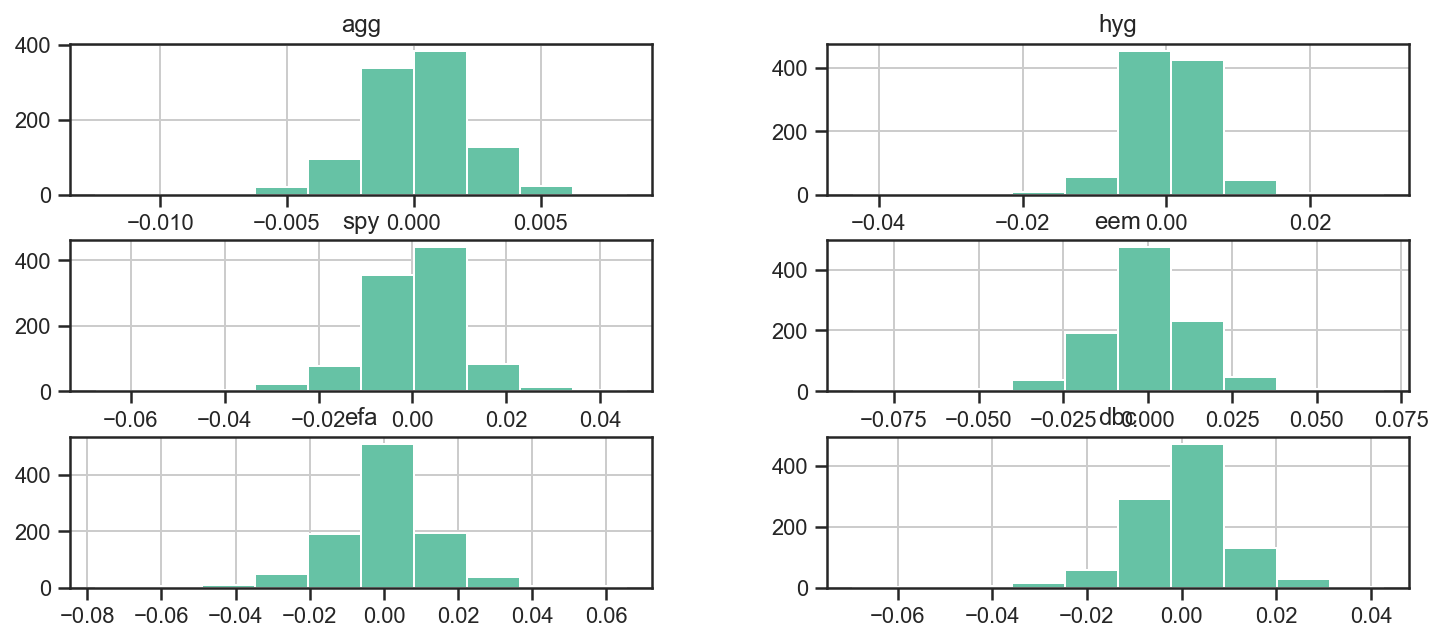

Let’s look at the different distributions to see how they look.

ax = returns.hist(figsize=(12, 5))

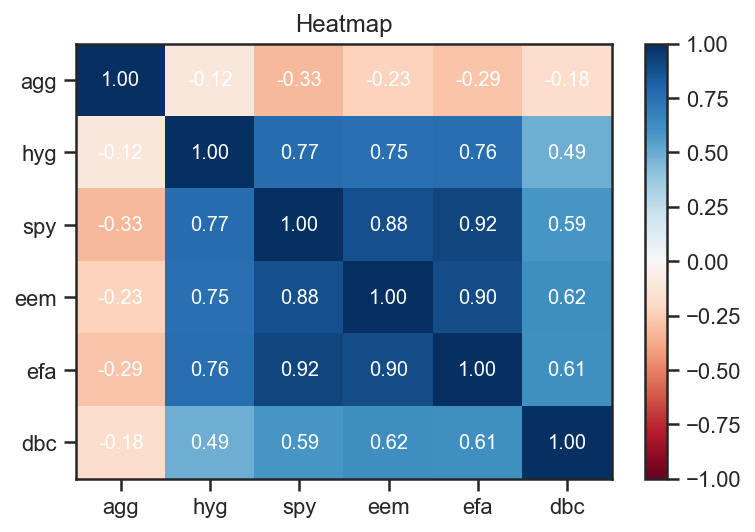

We can also use the numerous functions packed into numpy, pandas and the like to further analyze the returns. For example, we can use the corr function to get the pairwise correlations between assets.

returns.corr().as_format('.2f')

| agg | hyg | spy | eem | efa | dbc | |

|---|---|---|---|---|---|---|

| agg | 1.00 | -0.12 | -0.33 | -0.23 | -0.29 | -0.18 |

| hyg | -0.12 | 1.00 | 0.77 | 0.75 | 0.76 | 0.49 |

| spy | -0.33 | 0.77 | 1.00 | 0.88 | 0.92 | 0.59 |

| eem | -0.23 | 0.75 | 0.88 | 1.00 | 0.90 | 0.62 |

| efa | -0.29 | 0.76 | 0.92 | 0.90 | 1.00 | 0.61 |

| dbc | -0.18 | 0.49 | 0.59 | 0.62 | 0.61 | 1.00 |

Here we used the convenience method as_format to have a prettier output. We could also plot a heatmap to better visualize the results.

returns.plot_corr_heatmap();

We used the ffn.core.plot_corr_heatmap(), which is a convenience method that simply calls ffn’s ffn.core.plot_heatmap() with sane arguments.

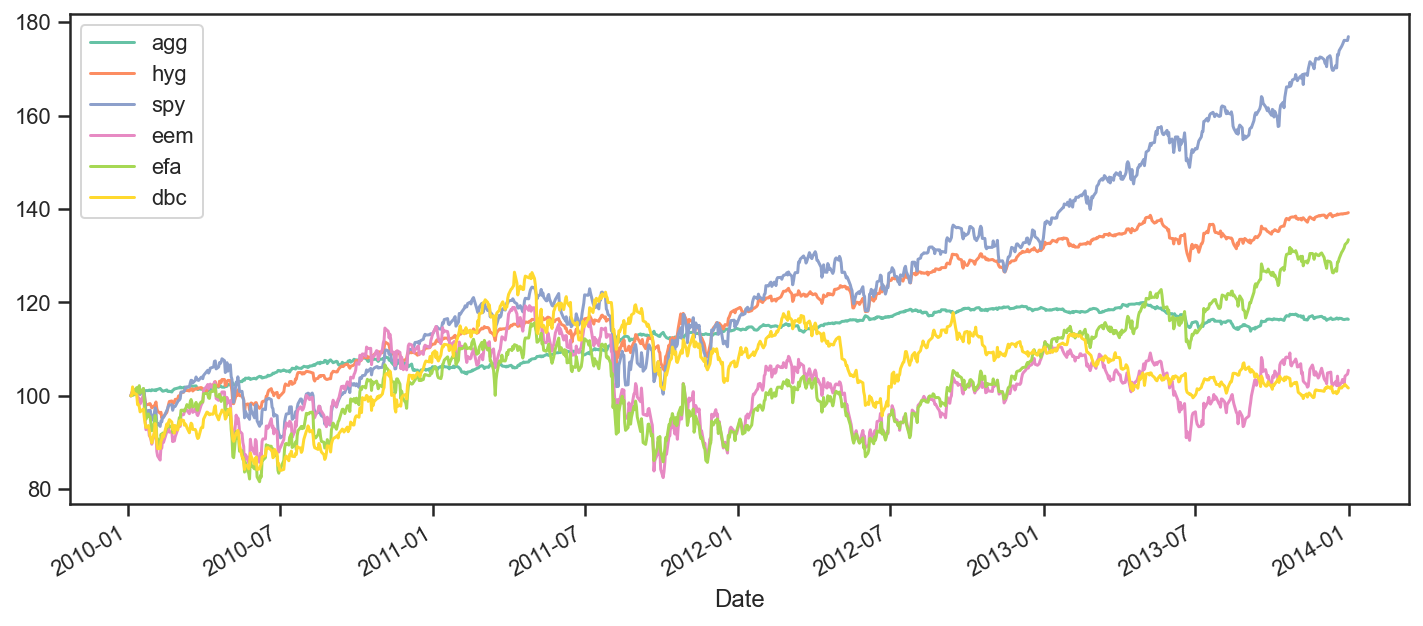

Let’s start looking at how all these securities performed over the period. To achieve this, we will plot rebased time series so that we can see how they each performed relative to eachother.

ax = data.rebase().plot(figsize=(12,5))

Performance Measurement¶

For a more complete view of each asset’s performance over the period, we can use the ffn.core.calc_stats() method which will create a ffn.core.GroupStats object. A GroupStats object wraps a bunch of ffn.core.PerformanceStats objects in a dict with some added convenience methods.

perf = data.calc_stats()

Now that we have our GroupStats object, we can analyze the performance in greater detail. For example, the plot method yields a graph similar to the one above.

perf.plot();

We can also display a wide array of statistics that are all contained in the PerformanceStats object. This will probably look crappy in the docs, but do try it out in a Notebook. We are also actively trying to improve the way we display this wide array of stats.

print(perf.display())

Stat agg hyg spy eem efa dbc

------------------- ---------- ---------- ---------- ---------- ---------- ----------

Start 2010-01-04 2010-01-04 2010-01-04 2010-01-04 2010-01-04 2010-01-04

End 2013-12-31 2013-12-31 2013-12-31 2013-12-31 2013-12-31 2013-12-31

Risk-free rate 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Total Return 16.36% 39.22% 76.92% 5.46% 33.43% 1.66%

Daily Sharpe 1.11 0.97 0.93 0.18 0.44 0.11

Daily Sortino 1.84 1.51 1.48 0.29 0.69 0.17

CAGR 3.87% 8.65% 15.37% 1.34% 7.50% 0.41%

Max Drawdown -5.14% -10.06% -18.61% -30.87% -25.86% -24.34%

Calmar Ratio 0.75 0.86 0.83 0.04 0.29 0.02

MTD -0.56% 0.41% 2.59% -0.41% 2.18% 0.59%

3m 0.02% 3.42% 10.52% 3.48% 6.08% -0.39%

6m 0.57% 5.84% 16.32% 9.55% 18.12% 2.11%

YTD -1.98% 5.75% 32.31% -3.65% 21.44% -7.63%

1Y -1.98% 5.75% 32.31% -3.65% 21.44% -7.63%

3Y (ann.) 3.08% 7.83% 16.07% -2.34% 8.17% -2.34%

5Y (ann.) - - - - - -

10Y (ann.) - - - - - -

Since Incep. (ann.) 3.87% 8.65% 15.37% 1.34% 7.50% 0.41%

Daily Sharpe 1.11 0.97 0.93 0.18 0.44 0.11

Daily Sortino 1.84 1.51 1.48 0.29 0.69 0.17

Daily Mean (ann.) 3.86% 8.70% 15.73% 4.35% 9.73% 1.83%

Daily Vol (ann.) 3.48% 8.97% 16.83% 24.56% 22.31% 16.84%

Daily Skew -0.40 -0.55 -0.39 -0.12 -0.26 -0.47

Daily Kurt 2.30 7.50 4.03 3.06 3.64 2.90

Best Day 0.84% 3.05% 4.65% 7.20% 6.74% 4.34%

Worst Day -1.24% -4.26% -6.51% -8.34% -7.46% -6.70%

Monthly Sharpe 1.23 1.11 1.22 0.30 0.60 0.27

Monthly Sortino 2.49 2.19 2.36 0.53 1.06 0.43

Monthly Mean (ann.) 3.59% 9.51% 16.99% 6.43% 11.06% 4.61%

Monthly Vol (ann.) 2.93% 8.56% 13.91% 21.45% 18.41% 17.10%

Monthly Skew -0.34 0.14 -0.32 -0.10 -0.37 -0.74

Monthly Kurt 0.02 1.75 0.24 1.28 0.17 1.16

Best Month 1.77% 8.49% 10.91% 16.27% 11.61% 9.89%

Worst Month -2.00% -5.30% -7.95% -17.89% -11.19% -14.62%

Yearly Sharpe 0.65 2.79 1.10 -0.06 0.50 -0.40

Yearly Sortino 2.77 inf inf -0.11 1.32 -0.58

Yearly Mean 3.16% 7.85% 16.73% -1.13% 9.32% -2.24%

Yearly Vol 4.86% 2.82% 15.22% 19.05% 18.72% 5.57%

Yearly Skew -0.54 1.49 0.22 0.58 -1.69 0.27

Yearly Kurt - - - - - -

Best Year 7.70% 11.06% 32.31% 19.05% 21.44% 3.50%

Worst Year -1.98% 5.75% 1.89% -18.79% -12.23% -7.63%

Avg. Drawdown -0.48% -1.18% -1.78% -5.16% -4.96% -5.09%

Avg. Drawdown Days 16.95 15.70 17.55 78.22 60.04 107.85

Avg. Up Month 0.83% 1.86% 3.58% 5.87% 4.37% 4.28%

Avg. Down Month -0.49% -2.31% -3.21% -3.41% -4.15% -3.35%

Win Year % 66.67% 100.00% 100.00% 33.33% 66.67% 33.33%

Win 12m % 81.08% 97.30% 94.59% 59.46% 70.27% 45.95%

None

Lots to look at here. We can also access the underlying PerformanceStats for each series, either by index or name.

# we can also use perf[2] in this case

perf['spy'].display_monthly_returns()

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD

------ ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

2010 -5.24 3.12 6.09 1.55 -7.95 -5.17 6.83 -4.5 8.96 3.82 0 6.69 13.14

2011 2.33 3.47 0.01 2.9 -1.12 -1.69 -2 -5.5 -6.94 10.91 -0.41 1.04 1.89

2012 4.64 4.34 3.22 -0.67 -6.01 4.06 1.18 2.51 2.54 -1.82 0.57 0.89 15.99

2013 5.12 1.28 3.8 1.92 2.36 -1.33 5.17 -3 3.16 4.63 2.96 2.59 32.31

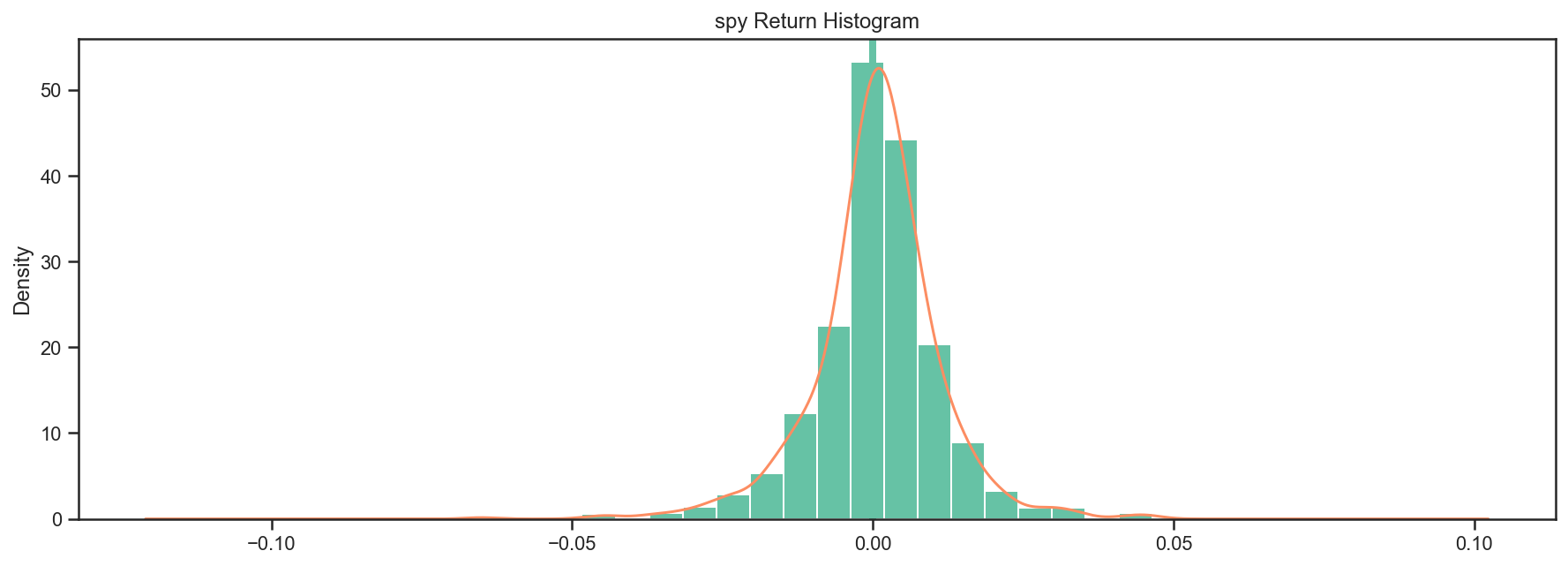

perf[2].plot_histogram();

Most of the stats are also available as pandas objects - see the stats, return_table, lookback_returns attributes.

perf['spy'].stats

start 2010-01-04 00:00:00

end 2013-12-31 00:00:00

rf 0.0

total_return 0.769155

cagr 0.15375

max_drawdown -0.186055

calmar 0.826367

mtd 0.025926

three_month 0.105247

six_month 0.163183

ytd 0.323077

one_year 0.323077

three_year 0.16066

five_year NaN

ten_year NaN

incep 0.15375

daily_sharpe 0.93439

daily_sortino 1.478916

daily_mean 0.157279

daily_vol 0.168323

daily_skew -0.388777

daily_kurt 4.028481

best_day 0.046499

worst_day -0.065123

monthly_sharpe 1.221065

monthly_sortino 2.362922

monthly_mean 0.169906

monthly_vol 0.139146

monthly_skew -0.319921

monthly_kurt 0.235707

best_month 0.109147

worst_month -0.079455

yearly_sharpe 1.099284

yearly_sortino inf

yearly_mean 0.16731

yearly_vol 0.152199

yearly_skew 0.21847

yearly_kurt NaN

best_year 0.323077

worst_year 0.01895

avg_drawdown -0.017845

avg_drawdown_days 17.550725

avg_up_month 0.035827

avg_down_month -0.032066

win_year_perc 1.0

twelve_month_win_perc 0.945946

dtype: object

Numerical Routines and Financial Functions¶

ffn also provides commonly used numerical routines and plans to add many more in the future. One can easily determine the proper weights using a mean-variance approach using the ffn.core.calc_mean_var_weights() function.

returns.calc_mean_var_weights().as_format('.2%')

agg 79.52%

hyg 6.47%

spy 14.01%

eem 0.00%

efa 0.00%

dbc 0.00%

dtype: object

Some other interesting functions are the clustering routines, such as a Python implementation of David Varadi’s Fast Threshold Clustering Algorithm (FTCA)

returns.calc_ftca(threshold=0.8)

{1: ['eem', 'spy', 'efa'], 2: ['agg'], 3: ['dbc'], 4: ['hyg']}