ffn - Financial Functions for Python¶

ffn is a library that contains many useful functions for those who work in quantitative finance. It stands on the shoulders of giants (Pandas, Numpy, Scipy, etc.) and provides a vast array of utilities, from performance measurement and evaluation to graphing and common data transformations.

If you are looking for a full backtesting framework, please check out bt. bt is built atop ffn and makes it easy and fast to backtest quantitative strategies.

A Brief Introduction¶

Here is a brief introduction to the capabilities of ffn:

import ffn

%matplotlib inline

# download price data from Yahoo! Finance. By default,

# the Adj. Close will be used.

prices = ffn.get('aapl,msft', start='2010-01-01')

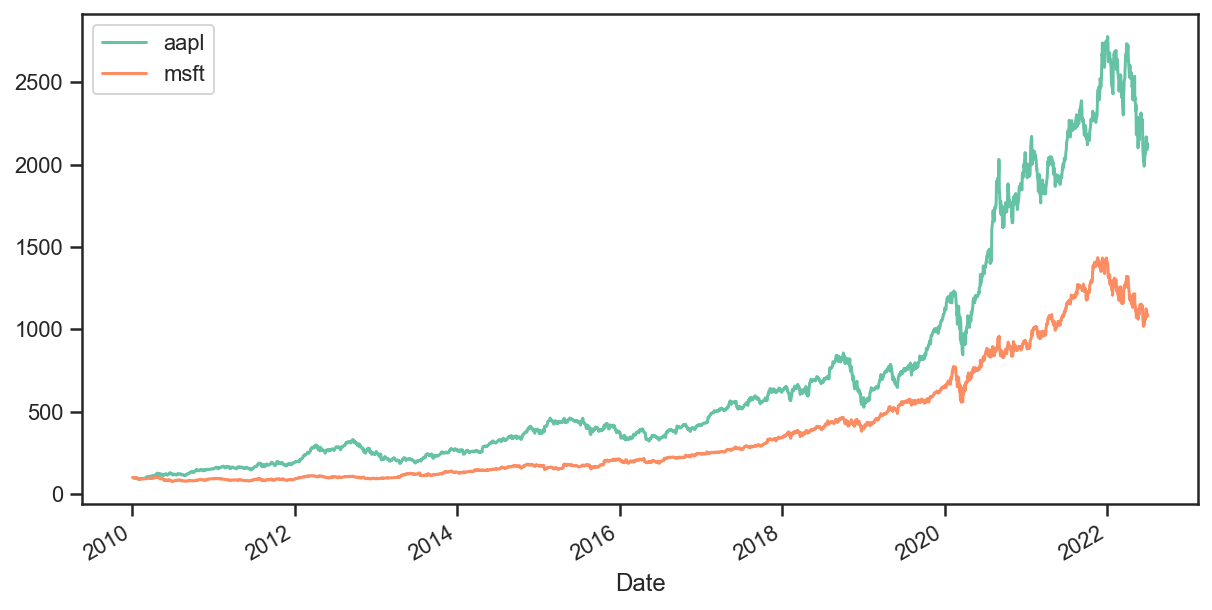

# let's compare the relative performance of each stock

# we will rebase here to get a common starting point for both securities

ax = prices.rebase().plot(figsize=(10, 5))

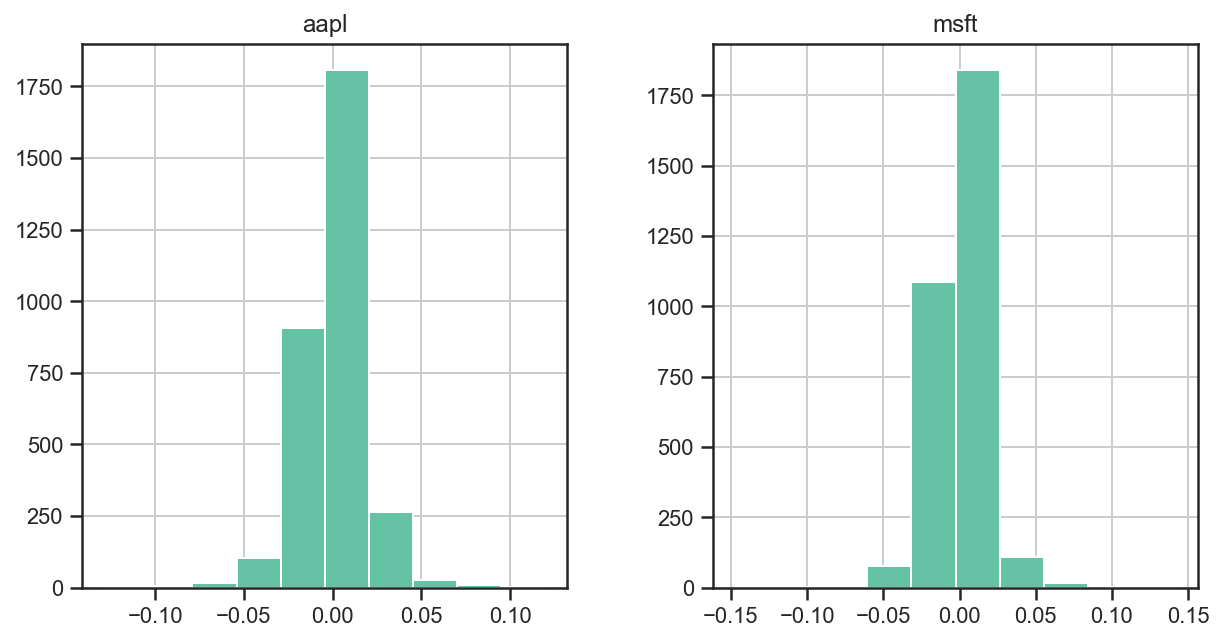

# now what do the return distributions look like?

returns = prices.to_returns().dropna()

ax = returns.hist(figsize=(10, 5))

# ok now what about some performance metrics?

stats = prices.calc_stats()

stats.display()

Stat aapl msft

------------------- ---------- ----------

Start 2010-01-04 2010-01-04

End 2022-06-30 2022-06-30

Risk-free rate 0.00% 0.00%

Total Return 1992.09% 979.11%

Daily Sharpe 1.00 0.87

Daily Sortino 1.66 1.45

CAGR 27.58% 20.99%

Max Drawdown -43.80% -29.08%

Calmar Ratio 0.63 0.72

MTD -8.14% -5.53%

3m -22.98% -17.98%

6m -23.07% -23.98%

YTD -22.79% -23.30%

1Y 0.40% -4.42%

3Y (ann.) 40.64% 24.96%

5Y (ann.) 32.03% 31.81%

10Y (ann.) 22.43% 26.28%

Since Incep. (ann.) 27.58% 20.99%

Daily Sharpe 1.00 0.87

Daily Sortino 1.66 1.45

Daily Mean (ann.) 28.42% 22.34%

Daily Vol (ann.) 28.40% 25.55%

Daily Skew -0.10 0.01

Daily Kurt 5.34 8.60

Best Day 11.98% 14.22%

Worst Day -12.86% -14.74%

Monthly Sharpe 1.08 1.04

Monthly Sortino 2.26 2.16

Monthly Mean (ann.) 29.20% 22.31%

Monthly Vol (ann.) 27.00% 21.39%

Monthly Skew -0.09 0.11

Monthly Kurt -0.33 0.41

Best Month 21.66% 19.63%

Worst Month -18.12% -15.14%

Yearly Sharpe 0.84 1.04

Yearly Sortino 4.34 3.73

Yearly Mean 28.54% 25.14%

Yearly Vol 33.85% 24.20%

Yearly Skew 0.47 -0.60

Yearly Kurt -0.27 -0.18

Best Year 88.96% 57.56%

Worst Year -22.79% -23.30%

Avg. Drawdown -4.29% -3.21%

Avg. Drawdown Days 29.95 25.20

Avg. Up Month 7.58% 5.39%

Avg. Down Month -5.20% -4.53%

Win Year % 75.00% 83.33%

Win 12m % 80.58% 90.65%

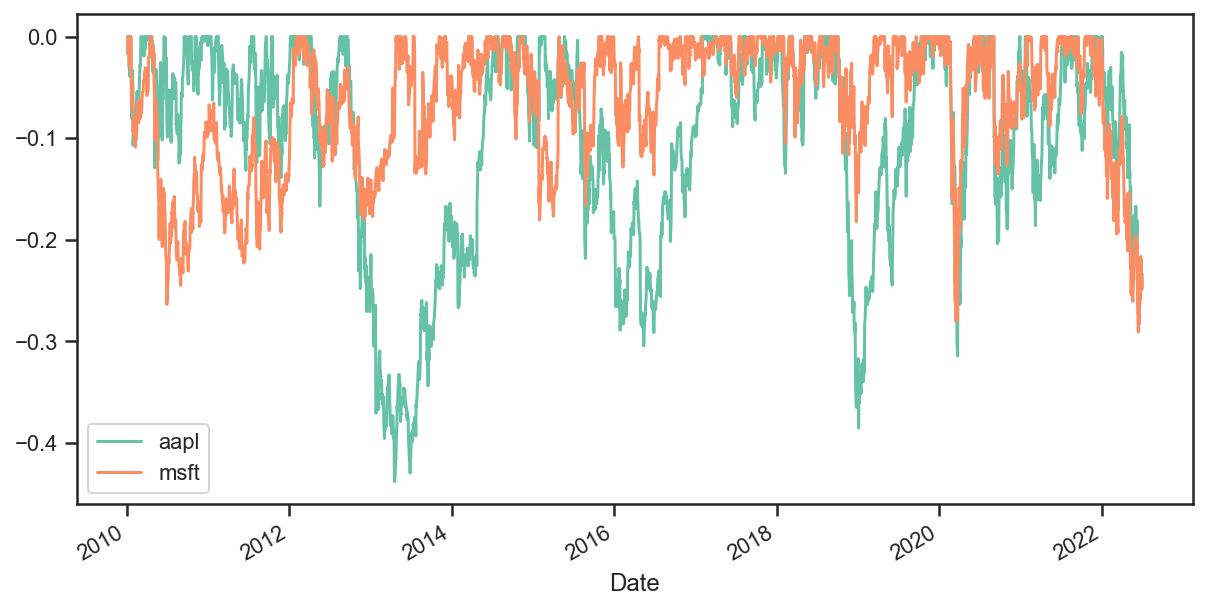

# what about the drawdowns?

ax = stats.prices.to_drawdown_series().plot(figsize=(10, 5))